European indices are expected to open around half a percentage point lower on Thursday, following in the footsteps of their U.S. and Asian counterparts which came under pressure on the back of oil’s sell-off late Wednesday.

It’s been a relatively slow week in the markets so far, with trading volumes being naturally hit in the run up to the long bank holiday weekend. Oil has been one of the few catalysts for the markets this week, which have been broadly stable barring the brief dash for safety following the tragic events in Brussels on Tuesday.

Apart from that it’s been a relatively light week on the data front, which has offered little direction for traders. Yesterday’s surprisingly large build in crude inventories – 9.4 million against expectations of 2.5 million – sparked them back to life a little, putting Brent and WTI crude under pressure and setting them on course for their first weekly losses in six.

We could see some more volatility in the markets today – albeit likely against a backdrop of lower volumes again – with retail sales data from the U.K. and durable goods orders from the U.S. being released. These are both extremely important economic indicators and offer great insight into the health of the respective economies.

The services sector currently makes up more than three quarters of the U.K. economy, of which retail sales is a significant component. Put simply, if consumers stop spending or, at least, take their feet off the gas at all, the economy would suffer considerably which could have significant knock on effects, both from a political and monetary perspective. Fortunately, despite wage growth still being underwhelming, consumers are continuing to splash the cash, although this is expected to slow a little this month, with core sales rising 3.4% compared to last year, down from 5% in January.

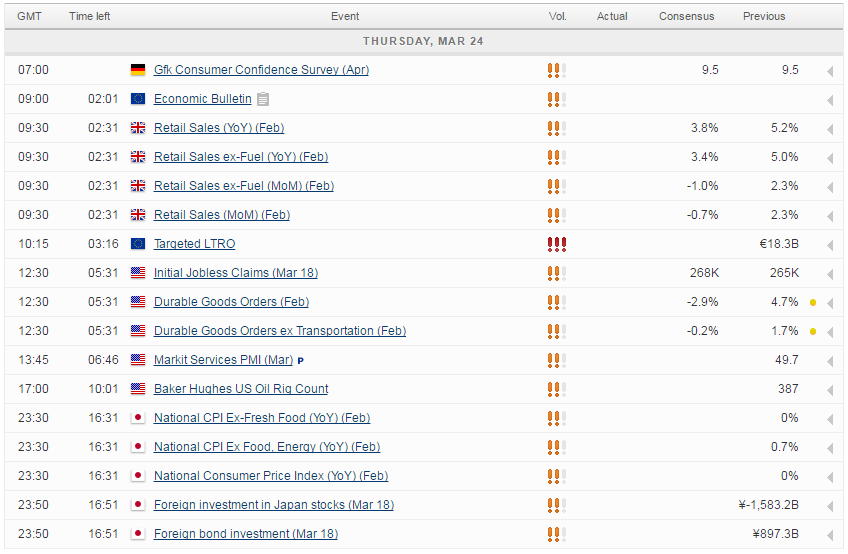

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.