The US Central Bank Is Not Anticipated to Hike Rates Opting Instead to Make Use of Rhetoric and Forecasts

Central banks around the world are running out of options to boost growth. The European Central Bank (ECB) over delivered last week in a better than expected easing monetary policy action. Along with a rate cut deeper into negative territory the central bank announced a 20 billion euros expansion to its quantitative easing (QE) program that is now 80 billion euros a month. The EUR did not react as expected and appreciated after comments from ECB President Mario Draghi and is now awaiting the Fed to do their part.

The U.S. Federal Reserve will publish the Federal Open Market Committee (FOMC) statement on Wednesday, March 16 at 2:00 pm EDT. The U.S. central bank is expected to keep the Federal funds rate unchanged at < 0.50 percent as economic fundamentals are weaker than those in December that prompted the first rate hike after starting an easing monetary policy 7 years ago. The market will focus on the economic projections and the language of the rate statement. Chair Janet Yellen's press conference starts at 2:30 pm EDT and will give more insight to investors about the confidence of the Central Bank on the state of the U.S. economy. The last FOMC press conference followed the much-awaited December rate hike.

The EUR/USD has been trading on a tight range after the market reaction to the European Central Bank (ECB). The EUR depreciated after the announcement of additional stimulus and deeper negative rates, only to reverse course as ECB President Mario Draghi took the stage to give more details on the easing program. Draghi’s comments of not foreseeing deeper negative rates and dismissing a two tiered deposit system was interpreted by the market as the CB being done intervening.

The euro is trading at 1.1110 and had a wide weekly range spanning from 1.0822 all the way up to 1.1218. The high and low of the week both happened in the aftermath of the ECB March easing policy announcement and press conference. The single currency remains caught in a tight trading range awaiting the FOMC statement as the market needs the other shoe to drop on monetary policy divergence in order to price it into the FX market.

The EUR/USD depreciated slightly on Tuesday. The EUR lost 0.028 versus the USD. The biggest movers of the day were commodity currencies due to the volatility in the energy market. The USD advanced against the CAD (0.73 percent) the AUD (0.77 percent) and the NZD (1.34 percent). Brexit fears have taken a toll on the British pound. The Swiss franc is seen as a safe haven and looks attractive to investors looking to hedge against the fallout of a Brexit. The GBP lost 1.19 percent versus the CHF and 1.24 percent versus the USD.

U.S. Economic Fundamentals have been mixed. Employment continues to be the strongest pillar but deep cracks are showing through on retail sales as consumers are saving more and spending less. The Fed had forecasted 4 rate hikes in 2016, but with current economic conditions those expectations could get adjusted during the release of the Fed’s economic projections. There is anxiety in the markets as the U.S. central bank could point to June as a strong possible FOMC meeting to announce a follow up to the December rate hike.

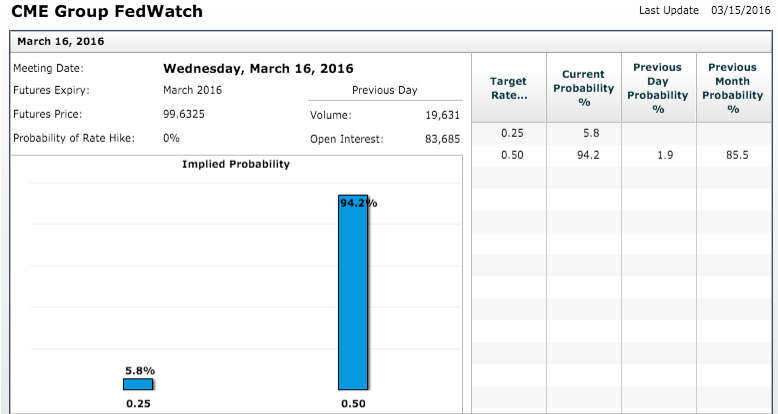

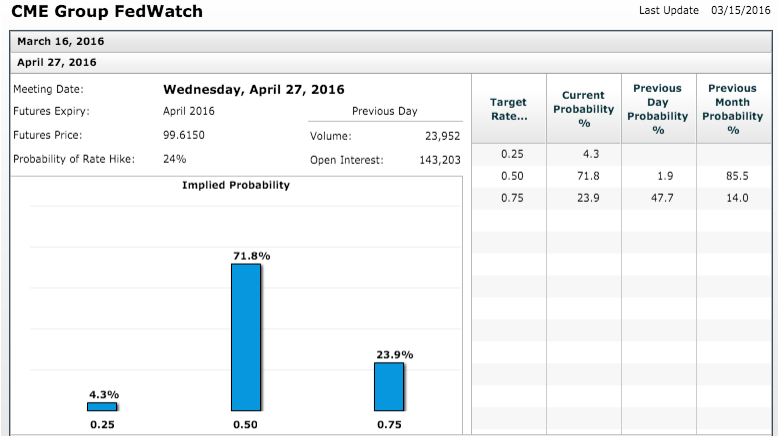

The CME FedWatch tool points to a 94.2 percent chance the Fed will keep the rate on hold at 0.50 percent in March. The odds improve for the June meeting with 23.9 percent of a rate hike priced in versus 71.8 percent of no change and a small 4.3 percent chance of a rate cut.

The market has seen the ECB do their part and is now looking to Washington to follow through on solidifying a monetary policy divergence. Chair Yellen and the Fed have endured their own communication disasters and will be cautious to try and give enough information to guide the market in the direction that is beneficial to the U.S. economy. Investors are growing weary of central bank actions and rhetoric so the task at hand for the Fed is not an easy one.

Fed to Remain on Hold and Choose Words Wisely

After keeping rates low and a quantitative easing (QE) program as a result of the crisis in 2008 the U.S. Federal Reserve delivered the much-awaited first rate hike to start a tightening monetary policy cycle in December. Weak economic indicators and a struggling global stock market after the Chinese turmoil at the start of the year have made the projected 4 rate hikes in 2016 farfetched. The sudden drop and recovery of oil prices have had a deep impact as commodity currencies outperform one day, only to give gains back the next day as volatility is fuelled by global record production with a possible oil output freeze in the near future.

The Federal Open Market Committee (FOMC) will release its statement on Wednesday, March 16 at 2:00 pm EDT. Given the reaction the market had to an aggressive showing by the European Central Bank (ECB) the Fed will be more careful in how it crafts its rhetoric as it won’t give hints on the next move by the central bank. The minutes from the December meeting released in January showed there were members who were not entirely convinced the economy was ready for a rate hike. The horrid start of the year has validated some of the concerns from those members and could delay a follow up rate hike until after June, but by then the election cycle would make it difficult for the central bank to intervene without pundits accusing the Fed of having a political agenda.

Forex Market events to watch this week:

Wednesday, March 16

8:30 am CAD Manufacturing Sales m/m

8:30 am GBP Annual Budget Release

8:30 am USD CPI m/m

10:30 am USD Crude Oil Inventories

2:00 pm USD FOMC Economic Projections

2:00 pm USD FOMC Statement

2:00 pm USD Federal Funds Rate

2:30 pm USD FOMC Press Conference

5:45 pm NZD GDP q/q

8:30 pm AUD Employment Change

*All times EST

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.