European markets are expected to open marginally higher on Friday to round off what has so far been a very good week for equities.

I think a number of factors have contributed to this week’s strong performance, particularly though the rebound in oil prices which was driven itself by an agreement between Russia, Saudi Arabia and some other OPEC members to freeze production at January levels.

While the deal was a step in the right direction, with the eventual goal being bringing supply back in line with demand, we got a swift reminder on Thursday why it simply isn’t enough, as crude inventories once again rose by 2.1 million barrels. It’s all well and good these countries agreeing not to increase output – not that they were expected to anyway – but when the market is already drowning in oil, what they’ve effectively agreed to do is keep it oversupplied. With Iran refusing to cooperate, the net effect of the deal is that output is likely to rise by between 500,000 and 1,000,000 barrels per day unless US shale production falls faster.

The drop off in oil prices in response to the inventory numbers appears to have weighed in the US and Asia overnight and could be broadly behind European futures struggling to build on this week’s impressive gains. Of course, we could also be seeing some profit taking at the first sign of any weakness which would be understandable given that we are still in quite a negative period for the markets.

This morning we’ll get the January retail sales figures from the UK, with spending expected to have rebounded by 0.8% following disappointing results in December. Core retail sales have broadly been in decline over the last year which is worrying given that the recovery has primarily been built on the consumer. That said, a strong rebound in January will hopefully indicate that the consumer isn’t done yet. This will be followed later by inflation data from the US, with core CPI seen remaining at 2.1%. Unfortunately, this is not the Fed’s preferred measure of inflation, which remains well below this.

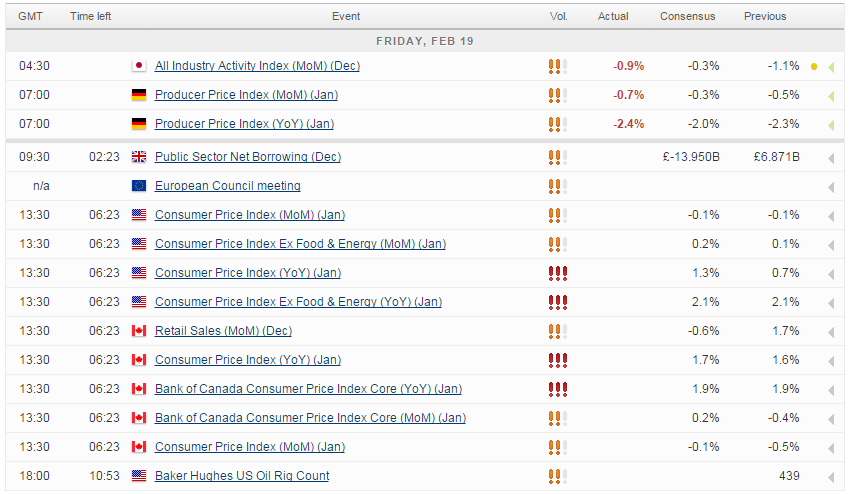

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.