European markets are expected to get a major boost when they open on Friday after the Bank of Japan became the latest central bank to adopt negative interest rates overnight, a move that appeared to catch markets off-guard despite numerous others having already taken similar action.

Prior to the meeting, I think the market was broadly split on whether we’d see any easing from the BoJ but for some reason, negative rates was not something that was widely being discussed. There were questions over the central banks’ ability to buy more government bonds and whether it would have to broaden the type of assets it could purchase, but there was very little talk of negative rates.

I think the action taken by the BoJ is the correct response given the extremely low levels of inflation and growth in the country, the latest decline in commodity prices and the added deflationary pressures that the stronger yen could bring.

The markets responded quite positively to the rate cut, even if we did see some wild swings in the first hour or so following the announcement. The yen is trading back above 120 against the dollar but still remains around 4% off last year’s peak. With the BoJ having now signalled its intention to fight against low inflation again though and utilise negative rates in order to do so, we could see the yen trading back at these levels quite soon. The only thing possibly holding it back today was the complexity of the new interest rates setup, with current bank reserves not being subject to the charges associated with negative rates.

It’s clear that they are not going to be the last central bank to take such action in the coming months, the ECB this month indicated that it would also consider easing further at its next meeting in March. This morning’s inflation data may support the need for more easing from the central bank. While the CPI flash estimate is expected to rise to 0.4%, from 0.2% last month, the core reading is expected to remain at 0.9%. The rise in the CPI figure just represents the decline in oil prices at the end of 2014 now falling out of the calculation, the actual inflation outlook still remains bleak.

Later on we’ll also get the advanced fourth quarter GDP reading from the U.S.. The economy is expected to have growth by 0.8% in the quarter which is quite good, especially when you consider that the rest of the world is experiencing slowing or simply very low growth. The question now is whether this can be sustained in a slowing global growth environment when the Fed is raising interest rates.

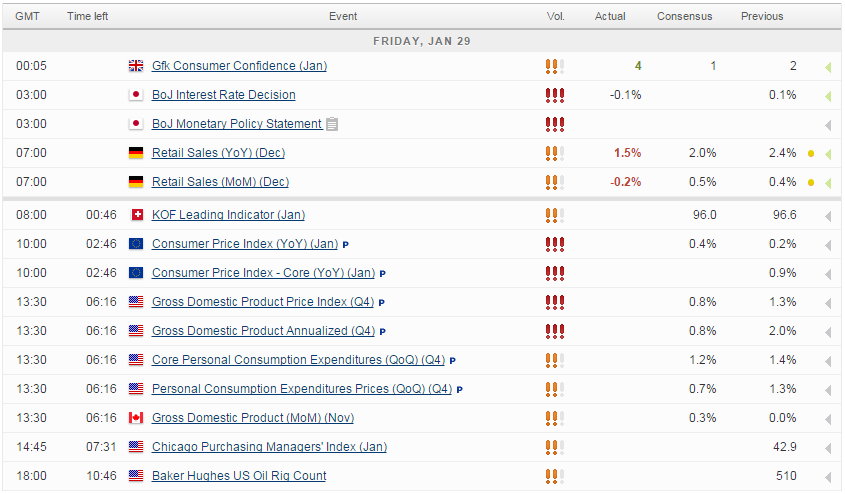

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.