US futures are pointing to a more positive open on Thursday, driven primarily by gains in oil which has been a key driver of equity markets as of late.

WTI crude is currently trading around 1% higher on the day, building on gains made on Wednesday which came following reports that the Russian ministry is open to discussing production cuts with OPEC. Oil appears to have found a bottom for now but I am not convinced that the bullish move over the last week or so has the legs to sustain a prolonged push higher. This just looks like a correction to me and I don’t see these reports of production cut discussions changing that.

Even if these discussions take place, this is only one small – albeit important – step towards a coordinated cut taking place and as it stands, the chances of this occurring remain quite slim. When markets are this oversold though and the short trade is so overcrowded, people are looking for any reason to lock in profit and allow the correction to take place and I think this is what we’re seeing. The question in my mind is when the sell-off is going to resume. We could see some interest around $32.10 in WTI crude, being the 50% retracement of the move from this year’s highs to lows. Above here, $34 in WTI could be key.

Another key factor in the markets right now is US monetary policy. Last night, US indices sold off late in the session in response to what was perceived to be a more hawkish Fed statement than the markets were expecting. I think people looked at the developments in the markets since the last meeting – broad China-driven sell-off and another substantial decline in commodities – and thought the Fed may take a step back having previously suggested that it will raise rates four times this year. While it did claim it is monitoring global economic and financial developments, it didn’t indicate that recent events have necessarily changed their intentions.

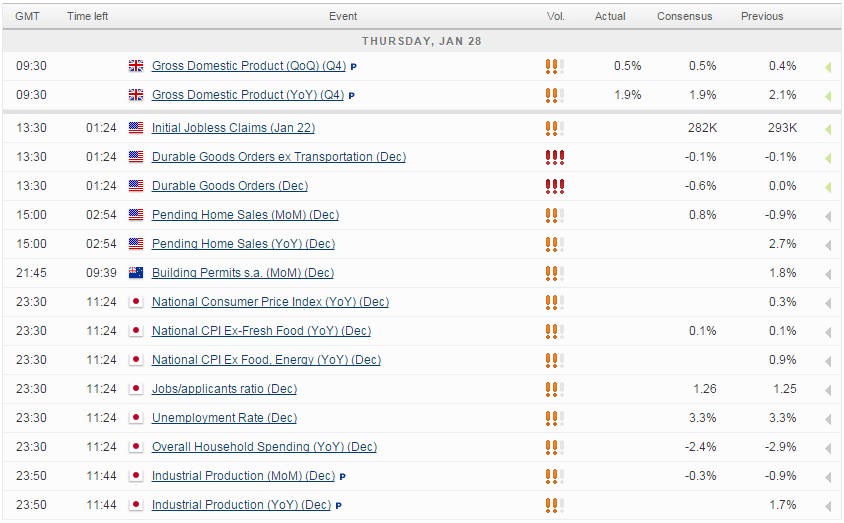

There are a number of important pieces of US economic data being released today, including core durable goods orders, jobless claims and pending home sales. We should also be aware of the key economic events that will take place overnight, most notably the Bank of Japan monetary policy decision. Already we’ve seen the ECB signal its intentions to ease monetary policy further in March and I would not be surprised if we get a similar commitment from the BoJ tonight, at the very least. We could even see monetary easing announced tonight, which could have an impact on global markets.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.