It’s been a volatile start to the week in financial markets and that doesn’t look like abating in the final week of the month, as the Federal Reserve and Bank of Japan announce their latest monetary policy decisions, we get a number of key economic releases and corporate earnings season gets into full swing.

The Fed decision and statement on Wednesday is likely to attract the most attention, following its decision last month to raise interest rates for the first time in almost a decade. Since then, the markets have been in meltdown, although I think the timing of it has little to do with the rate hike itself.

That said, it could heavily influence the pace of tightening going forward, with the Fed having previously indicated that it intends to raise rates another four times this year. The first of these is very unlikely to come this week and in fact, the Fed may use its statement to convey a much less hawkish message in an attempt to calm the markets further, building on the successful efforts of the ECB last week.

It’s the Bank of Japan decision on Friday that could be the main event this week though as the central bank may be about to announce another round of monetary stimulus. The Japanese economy has been stalling for some time and inflation has been non-existent. Add to this the recent appreciation of the yen on the back of safe haven flows and the BoJ may have little choice but to ease further.

Today is looking a little calmer, with German Ifo business climate the only notable economic release. ECB President Mario Draghi is also due to speak this evening in Frankfurt which, following his comments in the press conference last week, should be of interest.

The rebound in oil prices at the end of last week appears to be continuing so far today. While the bounce from those lows has been strong, I remain unconvinced and think all we’re seeing here is a correction. The market is too bearish and I struggle to see this rally lasting much longer. Brent appears to have eased its way through $32.50 which could have provided firm resistance having previously been support. The next key level for me is $34, at which point I think we could well see some interest once again.

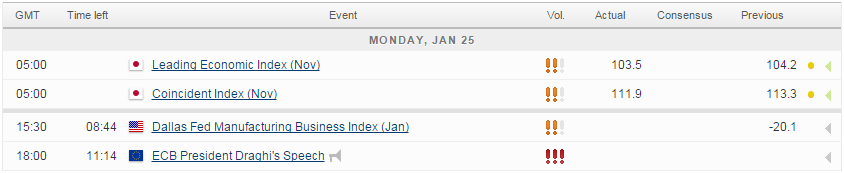

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.