Despite a disappointing morning in Europe on the data front, indices are on course to end the week on a far more positive note, extending gains to two sessions for only the second time this year. Having fallen into bear market territory this month, European indices have responded very positively and the rally at the end of the week looks far more convincing than the only other time they recorded two consecutive positive days, early last week.

I have no doubt that this reversal in fortune for equities has been spurred on by the prospect of more ECB stimulus in March, as strongly hinted at by President Mario Draghi on Thursday, as well as a rebound in commodity prices which is giving a big boost to oil and gas and natural resources stocks. This long overdue injection of positivity into the markets has prompted a move away from the safe haven plays that has been so prevalent this year and appetite for risk increase. Gold is under a little bit of pressure this morning, while the yen and Swiss franc are shedding some of their recent gains.

Even a poor batch of data from both the eurozone and the UK hasn’t tarnished sentiment this morning. Flash manufacturing and services PMIs from the eurozone, Germany and France were all weaker than expected this morning, pulling back from their recent highs as the region enters another year in which its long arduous recovery looks set to drag on. As always, it’s two steps forward and one step back for the region, although one potential positive this year may be that external factors are primarily responsible for its stuttering recovery, as opposed to the cracks forming from within. We can only hope.

Oil prices have rebounded strongly this morning, up more than 5% at the time of writing and trading back above the $30 handle. While it’s too early to suggest oil prices have bottomed – and personally I think we’re going to see them closer to $20 before that happens barring a fundamental change – oil is very oversold and now appears to have entered into a correction period. Given how fierce the sell-off has been until now, it will be interesting to see just how far these rallies are allowed to run before sellers see value once again. Both Brent and WTI could face their first real test around $32.50, with a move above here potentially opening a move back towards $35.

There is still some data to come from the US today, with manufacturing PMI and home sales data out shortly after the open. It’s also worth paying attention to the Canadian CPI data after the central bank opted against a rate cut at its meeting this month and delivered what appeared to be a less dovish statement than the markets were anticipating.

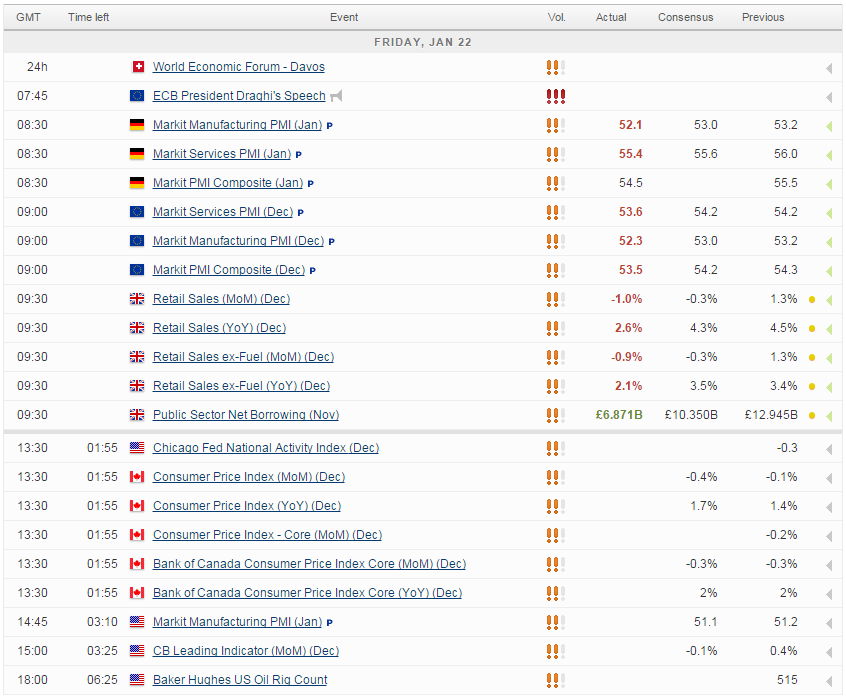

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.