European equity markets are expected to open around 1% higher on Tuesday following another rough start to the week on Monday, after Asian markets set a more positive tone overnight following some mixed reports on the Chinese economy.

Data overnight confirmed that the world’s second largest economy continued to slow in 2015, with full year growth slipping to 6.9%, the lowest levels since 1990. As is always the case with Chinese data, there are both positives and negatives to take away, while the question of reliability always hangs over the numbers.

On this occasion, I think the markets may have been relieved that the numbers were not as bad as they could have been, given the challenges facing the economy during this period of transition and slowing global growth. Moreover, the economy managed to grow at 6.9% with consumption accounting for 66.4% of this, up from around half in 2015.

While the figures will undoubtedly be called into question and the slowdown in other key sectors have been a factor, we should take comfort from the fact that the economy is transitioning away from manufacturing and exports and towards consumption as planned and still performing well in this challenging global economic environment.

There were of course some negatives in the data, with retail sales, fixed asset investment and industrial output all falling slightly shy of expectations. However, with the National Bureau of Statistics insisting that growth will remain stable and that supply side structural reform efforts maintained, there is perhaps reason to be optimistic. There is also the fact that there is still plenty of scope for fiscal and monetary stimulus to plug any gaps that appear in the coming years during this period of transition, which occurs at a time when the country is also trying to liberalise its markets, something that has faced many challenges already and will likely continue to do so this year.

It’s also interesting to note that the Shanghai Composite began this week trading around 2,850, at which point in August the Chinese authorities are believed to have intervened to bring some stability back to the markets. It does make you wonder how much of yesterday and today’s response is a case of returning confidence and the market stabilising, or whether there are other forces at play.

With the Chinese data now behind us and the markets having, so far, survived the threat of even more turmoil, focus will shift to the UK and Germany where we’ll get the latest inflation and ZEW economic sentiment data, respectively. Inflation is expected to pick up gradually in the coming months as the impact of the initially decline in energy prices falls out of the annual comparison. While we’re unlikely to see a big increase and any increase may be more moderate than previously anticipated because of the continued slide in oil prices, we should see the CPI number closer to 1% this year, rather than constantly flirting with deflation.

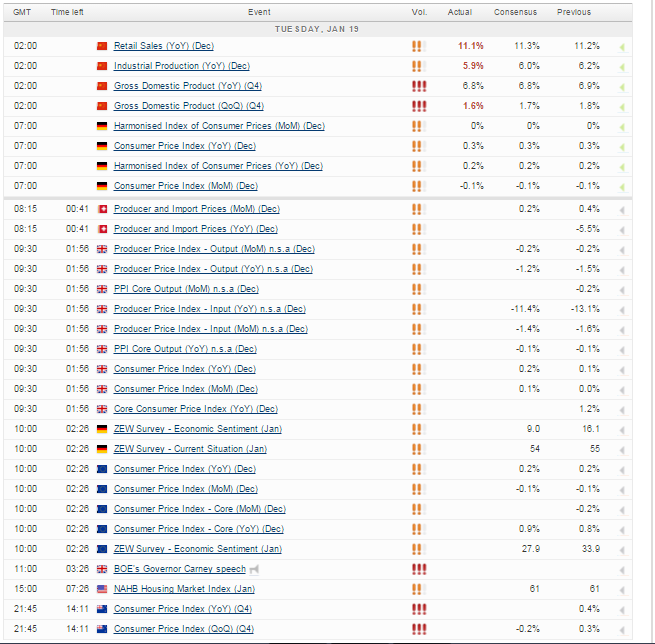

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.