Stock markets look set for another disappointing start to the week on Monday following another rough session in China which came despite the Yuan showing some signs of stability. The People’s Bank of China fixed the mid-point higher at 6.5626 today, which, along with other rumoured measures to slow the decline, appears to have brought an end to the sharp declines seen last week.

The fact that we’ve still seen significant declines in equity markets – the effect of which is weighing heavily on markets throughout Asia – suggests that sentiment remains very weak despite this stabilisation in the Yuan and more may need to be done to bring about a similar response. The removal of the circuit breakers – which were ironically installed to shield against rapid market sell-offs but instead encouraged them – does appear to have brought some calm back but as we’ve seen over night, investors still clearly have no confidence in the markets and remain bearish.

The ongoing decline in commodity prices is doing little to instil confidence in investors. Oil suffered considerable losses last week and have got off to another bad start today, as the oversupply story is once again being compounded by concerns over Chinese growth and demand. China is one of the world’s largest consumers of oil so any slowdown in the country leading to a fall in demand will only apply further downward pressure to prices at the worst possible time. It seems that oil in the low 20’s, which would have been unthinkable a couple of years ago, is now a real possibility.

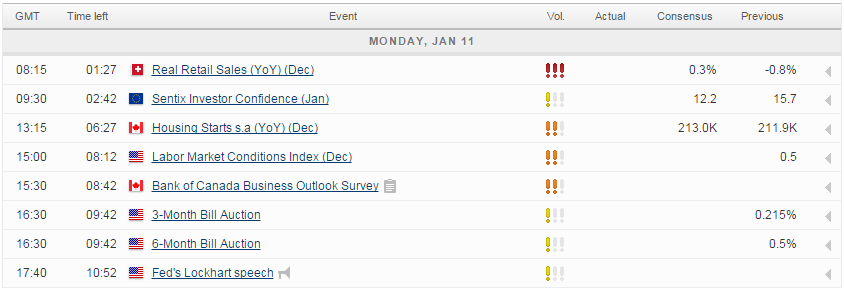

Once again we’re seeing the negativity around China feeding through into European markets this morning, with futures pointing to large declines. We’ll get the latest Sentix investor confidence reading from the eurozone this morning, which is expected to decline to 12.2 for January from 15.7 in December. This will be followed this afternoon by the labour market conditions index from the U.S. for December.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.