It’s been an incredible start to the new year and events in Asia overnight suggest it’s not going to ease up quite yet.

China was once again at the centre of the storm after the People’s Bank of China sharply devalued the Yuan, fixing it at its lowest midpoint since 2011. The move triggered another meltdown by investors, exacerbated once again no doubt by the new circuit breaker rules which have so far only serviced to spread more panic as the first 5% threshold has approached. Moreover, once this is triggered and the 15 minute break is enacted, it seems almost inevitable that the 7% threshold will be hit and trading will cease for the day. Chinese markets survived only 15 minutes in total today.

Chinese regulators have a real job on their hands in the coming days if they intend to prevent a repeat on the events in August when the Shanghai Composite fell almost 30% in just over a week. Already it’s down almost 12% in what has been an extremely turbulent opening week of 2016. Restrictions on large share sales – which comes into place as the previous ban is due to expire – could help to calm the markets a little but more will likely need to be done.

While the PBOC wishes to let the Yuan rate be more market driven – hence its new rate fixing structure – the aggressive devaluations appear to be the primary trigger for these wild market swings. In August, it was believed that the PBOC instructed state-owned banks to sell dollars on its behalf in order to halt the slide and it may take a similar response to halt the decline once again.

It will be interesting to see what the Fed response to yet more turmoil in China will be. The events of last August were clearly influential in the Fed opting to hold off on raising interest rates in September and I am convinced that has this week come a month earlier, the Fed would probably have held off once again in December. While last night’s FOMC minutes showed strong support for a hike, there is still clearly a nervousness within and this week’s events will not help to alleviate these concerns and I don’t think this is the last time we will face issues like this. With that in mind, I think the pace of tightening will be slower this year than the Fed is currently indicating.

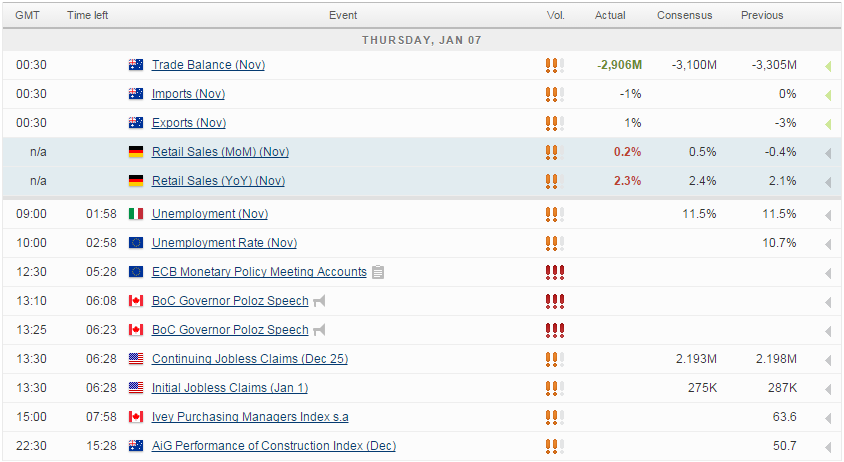

While events in China are likely to dictate market sentiment this morning – with European indices seen opening significantly in the red and safe haven flows clearly evident in Gold, the yen, euro and Swiss franc – there is some data due out that will be of interest. Eurozone unemployment is expected to remain at 10.7% having declined steadily from its peak over the last couple of years. Retail sales in the region are expected to have increased by 0.2% in November, up 2% on the same month a year earlier.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.