Asian markets, led by China, appear to have found some stability overnight despite another volatile start to the trading day on Tuesday, which is providing a temporary boost to European futures ahead of the open.

Heavy selling in China on Monday weighed heavily on global markets on the first trading day of the year, a move that was somewhat reminiscent of the market panic that spooked investors back in August. While people were quick to point the finger at the weak manufacturing PMI readings, I think there were other factors at play here that highlight the weaknesses in the Chinese stock market.

I think the move on Monday was primarily driven by a few key factors, which when combined with underlying weakness and a lack of confidence in China, prompted the kind of panic selling that no longer causes that much shock. I suspect the expiration of the six month ban on selling for large investors on Friday played a large part in Monday’s rout, while the implementation of new circuit breakers probably exacerbated the problem by prompting more anxiety among investors. The large retail presence in China doesn’t help matters, as we saw back in August, as they are more likely to jump on board rather than ride it out.

While Europe is currently poised to open higher on the back on the apparent stabilisation in Chinese markets, we’ve seen on numerous occasions before how quickly things can turn sour in China and given the fragility that will still be present after Monday’s rout, I would not be surprised to see the circuit breaker triggered again. This could prompt another negative day in Europe and add to the gloomy start to 2016.

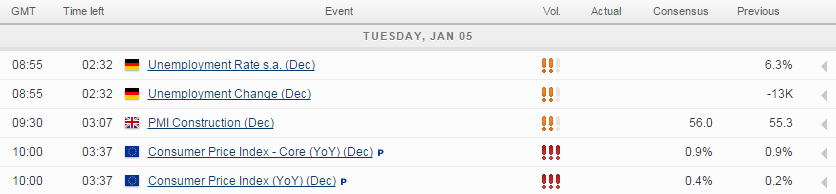

From an economic data standpoint, there are a few points of interest this morning. Unemployment data from Germany and Spain will be released around the European open, with both seen reporting moderate declines in December. We’ll also get the latest construction PMI from the U.K., while the eurozone flash CPI estimate for December will also be released. The inflation data in the coming months should pick up as last year’s decline in energy prices begins to drop out of the annual comparison although this will not be enough to bring it even close to the ECBs below but close to 2% target, despite its meagre attempt at stimulus last month.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.