WTI (West Texas Intermediate) Crude Oil showed plenty of volatility over the course of 2015, as oil prices have plunged some 31%, as of the first week in December. As we prepare to bid adieu to the past year and welcome in a new year, let’s examine the major trends that will likely have an impact on the price of oil over the course of 2016. Before we look at expectations for 2016, we provide a brief review price of oil during that period:

WTI Crude Oil Prices in 2015

Open $54.23 (January 1)

High: $62.58 (May)

Low: $37.32 (December)

Close $37.32 (December 7)

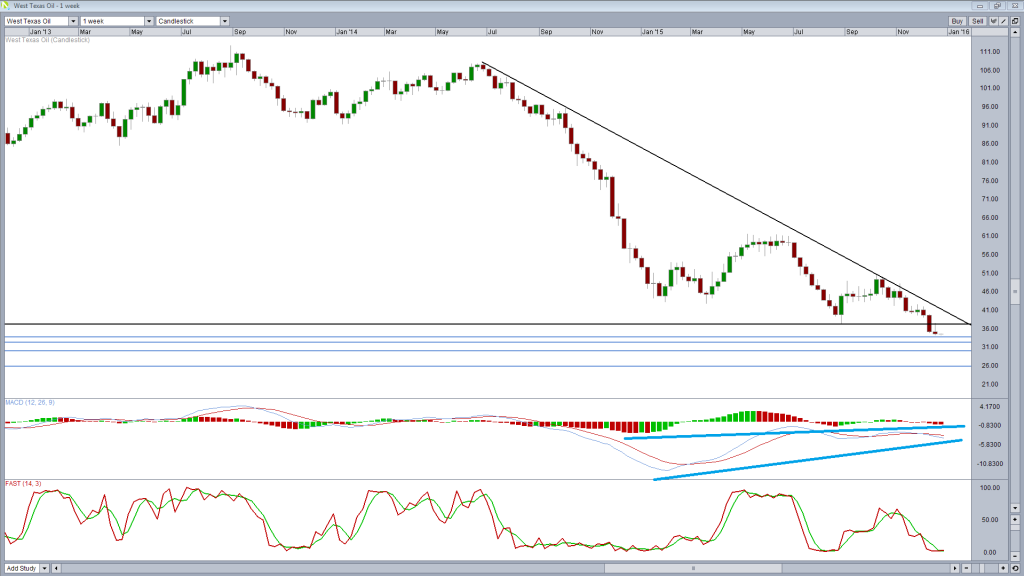

The second half of 2014 saw a sharp drop in the price of WTI Crude Oil, which had traded at $105 a barrel in July. By January 1, 2015, the price of crude had fallen by almost 50%, to $54.45 a barrel. Oil prices rebounded in April, reaching a high of $62. However, this rise was short-lived, as crude dropped sharply in July and dropped below $38 in August. Oil prices hovered close to $45 in September and October, but have since weakened. Currently, crude oil is trading at $37.32, the yearly low, and could easily set new lows for 2015 before the end of December.

WTI Expectations for 2016

China

China is the world’s second biggest economy and also the second largest consumer of oil, and any changes in its appetite for oil can have a significant effect on the price of crude. In 2015, weaker growth for the Asian giant led to decreased demand for oil, and this has been a major factor in low oil prices. Chinese GDP slowed in the third quarter of 2015 to 6.9%, marking a six-year low. The manufacturing and construction sectors have also declined, resulting in a decreased demand for oil. Will the Chinese economy rebound in 2016? If not, oil prices could remain at the current depressed levels or drop even lower.

Global Growth

Global growth is directly linked to the price of oil, as stronger demand for oil should result in higher prices (assuming no change in production levels). As discussed above, China is the second largest importer of oil in the world, so the slowdown in China has resulted in lower global growth and hence, a decreased demand for oil. This direct link between Chinese growth and global growth was reiterated when China released its GDP reading of 6.9% for the third quarter. Immediately following this release, one economic forecaster, Oxford Economics, cuts its forecast for global economic growth in 2015 from 2.6 percent to 2.5 percent, and for 2016 from 3.0% to 2.7%. If global growth is only marginally higher in 2016 compared to 2015, then oil prices will clearly not be driven up based on global demand.

Iran

Western sanctions against Iran hurt the Iranian economy and took a bite out of Iranian oil revenue as well. The country oil’s exports fell as low as 1 million barrels a day. However, rather than cut back on production, which was about 2.5 million barrels a day, Iran decided store the excess oil on tankers, leading to a glut of some 50 million barrels parked off the Iranian coast. With the signing of the nuclear agreement with the Western powers, Iran is preparing to sell this excess oil, but will have to wait until January or February and receive the green light from the International Atomic Energy Agency that Iran has complied with the nuclear agreement. All signs indicate that the IAEA will give Iran the green light, and Iran can be expected to immediately boost oil production, which means that that global supplies of oil will increase, which should help keep in check any sustained price rise and even contribute to lower prices.

OPEC

OPEC member countries, led by Saudi Arabia, produce about 40 percent of the world’s crude oil. As well, OPEC’s oil exports represent about 60 percent of the total petroleum traded internationally. This means that OPEC has a huge say in the price of crude oil. Although OPEC countries are supposed to operate within the organization’s guidelines, members have historically cheated on their production quotas, resulting in production targets and ceilings that are not honored. At last week’s key OPEC meeting in Vienna, members failed to reach an agreement on production cutbacks. The statement issued after the meeting was noticeable in that it failed to mention a production target, as previous OPEC meetings have at least stated a production target, even if historically OPEC members over-produced and failed to meet this goal. This points to deep discord amongst the OPEC nations, which means that oil prices could continue to head south. OPEC members (as well as other oil producers) have shown little inclination to reduce their market share and cut back production, resulting in a huge global glut of oil that has led to a serious shortage of land-storage facilities, as dozens of oil-laden tankers remain at sea. With little reason to expect this state of affairs to change anytime soon, continuing high production levels mean that the oil glut will continue, leaving oil prices little room to move except downwards.

US Shale

The extraction of oil from oil share is more complex and hence more expensive than extracting conventional oil, but the industry continues to develop. OPEC producers deliberately kept production levels high in order to depress prices and bury the shale industry, but this hasn’t succeeded, as the industry continues to develop. Improved technology and more efficient operations have led to a more competitive industry which will continue to compete with the conventional oil producers. Thus, the shale industry has become a key source of oil production in the US, which boasts the world’s largest deposits of shale rock. This in turn has led to higher US oil production, which has contributed to the world oil glut and kept oil prices at low levels.

Geopolitical Factors

Geopolitical considerations can play an important role in the price of commodities, including oil. Of course, there is no way to predict such events ahead of time, but it’s safe to say that flash-points in the Middle East, which could result in the interruption of oil production or its shipment, could lead to rise in oil prices. As well, any political or economic disorder in Russia, the world’s third largest oil producer, could lead result in oil prices rising. At the same time, it should be remembered that more often than not, the markets respond to such events with volatility for only a brief period; this may create opportunities for traders, but is unlikely to have a lasting effect on the price of oil, which may spike during a crisis, only to fall back to earlier levels.

Technical Analysis

WTI is already trading at its lowest level since February 2009 and with the fundamental factors not seen abating any time soon, further losses are expected. Key technical support can currently be found $32.30, a break of which will see WTI trading at its lowest level since 2003. Momentum in the sell-off does appear to be easing, with the last two lows coming on the back of falling momentum on the MACD. While this doesn’t mean WTI has bottomed, it may suggest that we’re going to see some consolidation or even a correction in the short to medium term. The former appears more likely at this stage. A break above the descending trend line – June 2014 highs – may suggest that we’re seeing this. Further losses do appear likely still and $30 could offer some support in 2016, although it would not be a huge shock if even this is broken, at which point April 2003 lows of $25.80 will be eyed.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.