Markets will spend much of this week absorbing the events of the past seven days and positioning itself ahead of next week’s crucial monetary policy decision from the Federal Reserve, which could see interest rates rise for the first time in almost a decade. With data light on the US and European side, attention will shift to Asia, predominantly China, where a number of key economic indicators will be released throughout the week.

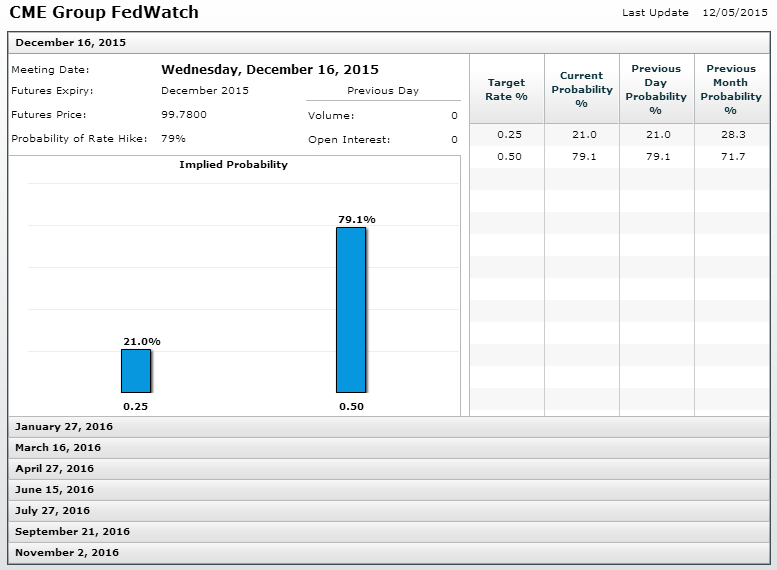

Last week’s ECB meeting was very disappointing for the markets as the central bank failed to follow through on what we’d been led to believe was going to be a substantial stimulus package. I can’t help but think that policy makers had one eye on the policy decision of another central bank across the Atlantic, which is expected to raise rates next week and could partially do its job for it. A good jobs report on Friday may well have been the final piece of the puzzle and markets appear to have little doubt now that the Fed will hike next week, with Fed Funds futures pricing in a 79% chance of an increase.

Source – CME Group FedWatch Tool

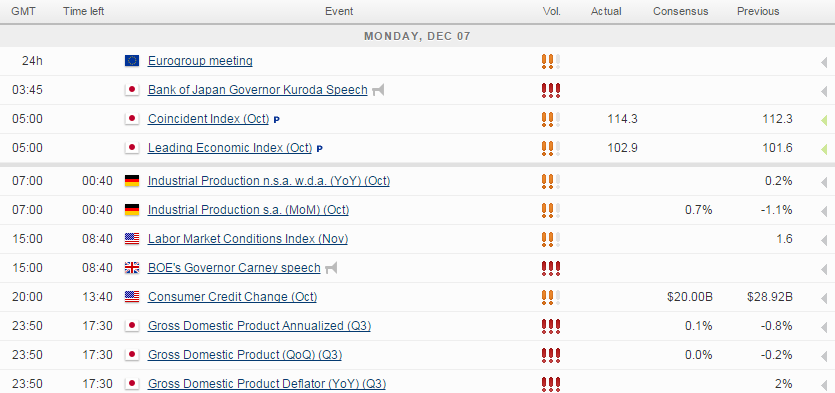

Bank of England Governor Mark Carney will testify before the European Parliament Committee on Economic and Monetary Affairs, in Brussels this afternoon, only three days before the central bank is due to announce its latest monetary policy decision. No change is expected from the BoE on Thursday, following Carney’s recent warnings that we could be waiting for some time for the first hike, a significant change from the central banks’ prior assessment in which it hinted that it could be considered around the turn of the year.

While I have no doubt that the BoE has a very difficult job on its hand in deciding when it will be appropriate to begin the rate hiking cycle, given the impact of the strong pound on the economy and the weakness in its largest export partners, I feel the clear confusion within the central bank on the subject is coming across to the markets. The BoE doesn’t appear to want to commit one way or another which tells me that it is no more sure on when rates will rise than any of the rest of us.

Carney may offer some further insight on this today but I doubt he’ll give too much away. I think the market view that we won’t see a hike until late next year or early 2017 may be overstretching it a little, given how well the economy is still performing and how much tighter the labour market is. The middle of next year may be more appropriate, although I guess this may well depend on whether we see any evidence of inflation returning to the 2% in the medium term between now and then. The impact of lower commodity prices should fall out of the data by then and give a much clearer indication of real price pressures in the UK.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.