While the bulk of this week’s key economic events will happen in its final 48 hours – ECB decision, U.S. jobs report and OPEC meeting – there are a number of important economic releases and speeches today that could get the markets worked up as we enter such a crucial period.

This morning’s eurozone flash CPI inflation readings probably come too late to have much influence on tomorrow’s ECB decision, with recent comments from officials suggesting the decision to ease is all but made and perhaps the only discussion still to be had is how far they go. With the camp not unanimous in its desire to ease – opposition primarily coming from Germany – today’s data could possibly still influence how aggressively they will ease, with any unexpected pickup in the data supporting a less bold approach.

As it stands, the market is expecting a 10-20 basis point cut to the deposit rate and €10-20 billion increase in the bond buying program. A move at the lower end of this scale could disappoint investors, especially given the ECBs history of over-delivering once the decision to ease has been made.

Of course, that could depend on what is responsible for any uptick in the inflation data. We are now entering a period in which last year’s collapse in commodity prices should start to fall out of the yearly comparison and the headline figure should start to pick up significantly. This should not be reason not to ease though as this should have little impact on the core reading or the fact that inflation still remains well below the ECBs target rate of below but close to 2%.

We’ll get our first insight into how strong Friday’s U.S. jobs report could be this afternoon, as we get the November employment figures from ADP. This number is intended to be an estimate of Friday’s non-farm payrolls but in my experience, the first reading in particular tends to be fairly inaccurate and last month, the numbers weren’t even close. That said, this is all the markets have and therefore any big swings in the data is still likely to get a response, particularly ahead of such an important report on the labour market.

Also of note today is the nonfarm productivity and unit labour costs data as they provide important insight into future inflationary pressures which under the current circumstances is very important to the Federal Reserve. We’ll also hear from Fed Chair Janet Yellen this evening which could be extremely interesting ahead of what is being seen as such an important jobs report and a couple of weeks before what could be the first rate hike in almost a decade. It will be interesting to see if Yellen addresses the ECBs decision tomorrow, whether it will influence the Fed’s decision making and just how important Friday’s labour market data really is.

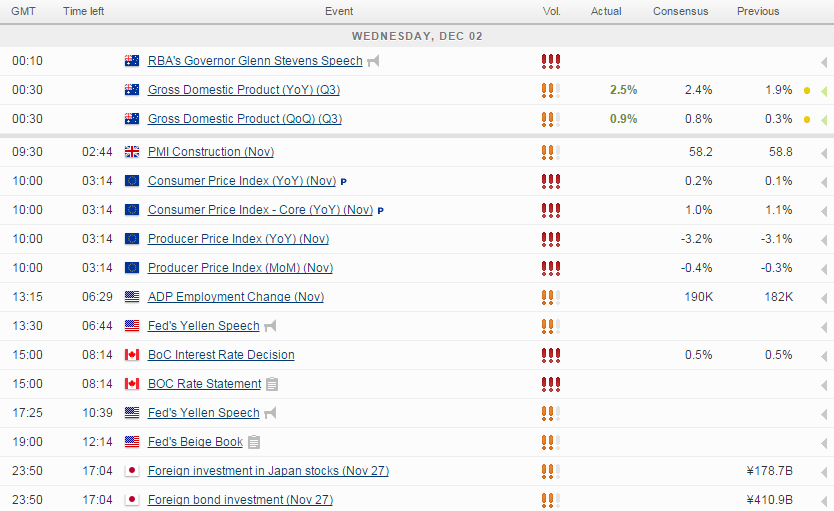

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.