The Aussie dollar is rallying against its U.S. counterpart again on Monday after undergoing a correction in the second half of last week.

The pair broke above the long term descending channel a couple of weeks ago and while the move higher has been far from convincing since, it appears we could see another slow grind higher in the days ahead.

The bulls took control again around the 50 fib level – 18 November lows to 25 November highs – which suggests the sell-off towards the end of the week was just a retracement and there’s still appetite for more gains. What’s more, if the pair closes the day above 0.7227, we could have a bullish engulfing pattern which again points to further gains going forward.

The next test for the pair could now come at last week’s highs, around 0.7282, with a break of this potentially opening up a move towards what’s proven to be a key resistance zone over the last four months, between 0.7380-0.7440.

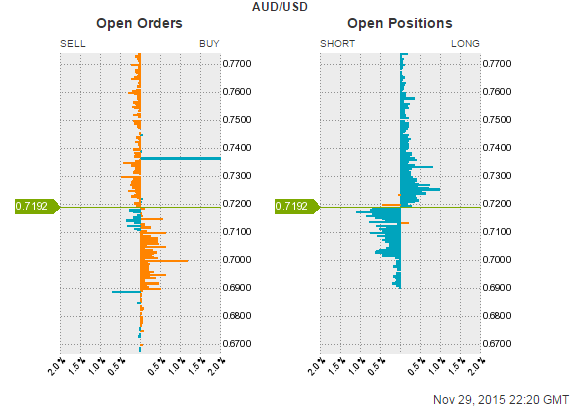

As you can see below, OANDA traders remain undecided on the pair and are unconvinced by the recent rally and breakout.

There is a lot of open buy orders around last month’s highs – 0.738232 – which may suggest that if the level is broken, we could see a more convincing rally than we’ve seen so far. That said, we’re still some way from hitting that level as it stands.

To get access to our Open Positions and Order Book tools, visit OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.