While investors in the U.S. do return from the Thanksgiving bank holiday on Friday, we can expect light trade again today with many taking an extra day off and turning it into a long weekend break. That is often the case, particularly when the bank holiday falls so close to the weekend.

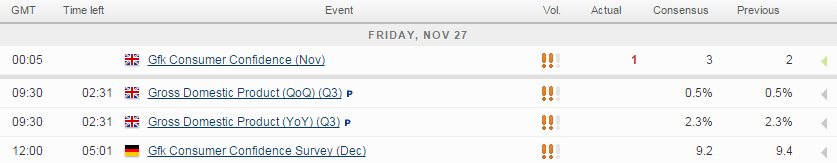

The quieter schedule probably won’t help matters either, particularly from a U.S. standpoint, although there is some data scheduled for release this morning that will be of interest. The first revision of U.K. third quarter GDP is due early on in the European session and is expected to remain unchanged at 0.5%.

The U.K. economy is continuing to face a number of headwinds at the moment which are likely to persist into next year, most notably the strong pound and anaemic growth in the eurozone, it’s largest trading partner. In the absence of either of these pressures easing, we could see growth remain at these decent, albeit uninspiring, levels in the coming quarters, which explains why the Bank of England is in no rush to raise interest rates. Especially at a time when the euro is depreciating as the ECB looks to ease monetary policy further, a BoE rate hike on top would exacerbate the strong currency issue even further.

Pressure is building on the Bank of Japan to boost its bond buying program in the coming months despite clear resistance within, as another batch of inflation and spending data points to a prolonged period of weakness. Despite unemployment falling to 3.1%, the latest core CPI data which strips out volatile food prices fell by 0.1% while possibly more worryingly, household spending fell by 2.4%.

It’s the same old story wages not growing and therefore consumers not spending. While low energy prices do distort the data to an extent, price pressures are still very weak and the situation is showing little sign of changing as wages just aren’t rising, despite corporate profits being a record levels. With the country falling back into recession in the third quarter, the BoJ needs to seriously consider further stimulus options as the current program isn’t working and any hope of hitting its 2% inflation target is quickly fading. Prime Minister Shinzo Abe also needs to rethink his strategy as Abenomics is currently failing and little appear to be being done to resolve that.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.