European indices are expected to open relatively unchanged on Monday as investors look ahead to the slew of PMI readings from the eurozone this morning, having received little direction from Asia overnight.

The flash manufacturing and services PMIs are some of the more closely followed indicators for the eurozone nowadays as they offer good insight into whether conditions are expected to improve following another disappointing year for the region. The eurozone has become trapped in a marginal growth, low inflation environment and the fierce global headwinds are making it all the more difficult to overcome.

The manufacturing sector is the latest to come under pressure due to the slowdown in emerging markets, which the euro area conducts a lot of trade with, particularly China. The services sector has offered some reprieve as consumers benefit from the lack of inflation driven largely by lower energy prices. Unfortunately, this is not expected to last for much longer and with unemployment still very high and wage growth non-existent, we can’t rely on the consumer to drive a strong sustainable recovery in the euro area next year.

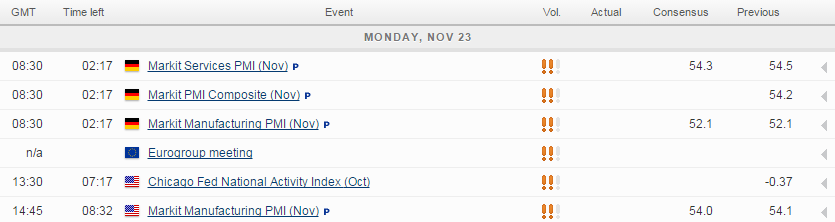

Today’s flash readings are expected to show that the manufacturing outlook is unchanged in November, while service sector growth is also expected to cool slightly. The fact that the PMI data continues to point to only moderate growth in the eurozone further supports the need for more monetary stimulus from the European Central Bank which is expected to come at the December meeting. ECB President Mario Draghi once again alluded to such a move on Friday, claiming that the central bank will do what it must to raise inflation as quickly as possible, if it decides that it is not on target to hit its target, which it clearly no longer is.

EURUSD

The euro is once again testing 1.06 support this morning and a break of it could prompt a move back towards this year’s lows, making parity by year end all the more likely. That said, each leg lower recently has come against the backdrop of falling momentum which may suggest that the bulk of the pre-stimulus move is now done and the trade potentially looking a little overcrowded. That’s not to say we can’t see a move back towards 1.0450-1.05 in the coming days but in the absence of momentum, I find it difficult to be overly bearish at these levels.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.