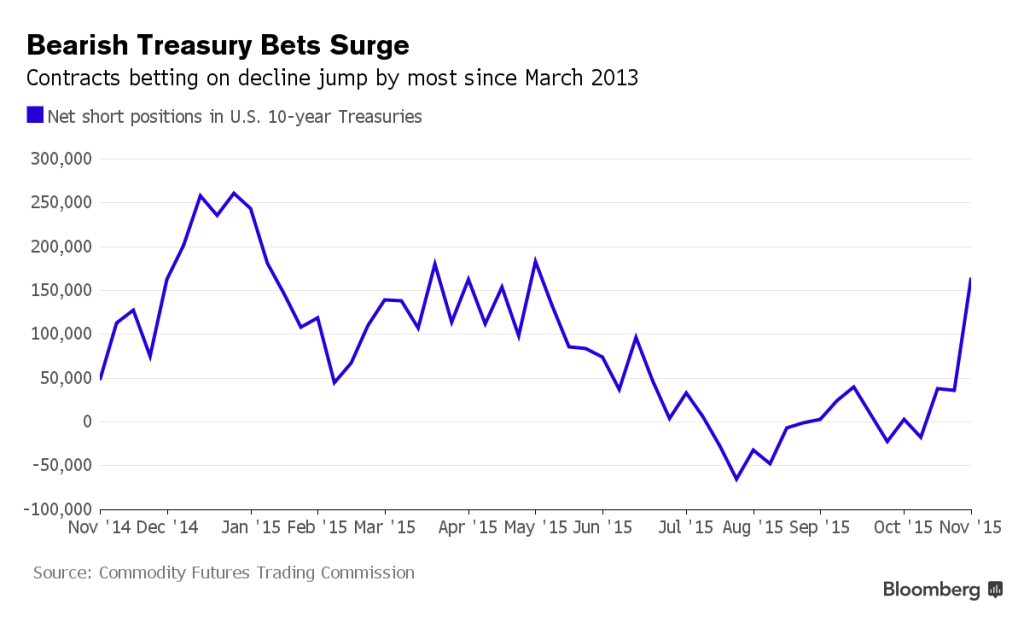

Hedge funds picked just the right time to boost bearish bets on Treasuries by the most since March 2013.

Large speculators including hedge funds increased net short positions in 10-year notes by 128,601 contracts to 164,264 in the week ended Nov. 3, data from the Commodity Futures Trading Commission show. Treasury yields rose to the highest since July on Friday after data showed U.S. employers unexpectedly added the most jobs this year in October. Traders see a 68 percent chance the Federal Open Market Committee will raise interest rates at its December meeting, up from 56 percent odds before the payroll data.

“This was a very strong report,” said Imre Speizer, a senior market strategist at Westpac Banking Corp. in Auckland. Ten-year U.S. Treasury yields “could rise as far as the June high of 2.50 percent before the December FOMC,” he said.

The U.S. 10-year note yield rose two basis points, or 0.02 percentage point, to 2.34 percent as of 10:11 a.m. in London, according to Bloomberg Bond Trader data. The price of the 2 percent Treasury maturing in August 2025 fell 5/32, or $1.56 per $1,000 face amount, to 97.

The yield jumped as much as 11 basis points on Friday to 2.35 percent, the highest since July 21. It had dipped as low as 1.90 percent in early October, approaching the lowest level since April.

Japan’s 10-year government bond yield rose one basis point to 0.335 percent. Equivalent-maturity Australian sovereign yields jumped 11 basis points to 2.91 percent, the highest since July.

The Labor Department said the U.S. gained 271,000 jobs last month, following an increase of 137,000 in September. The median forecast in a Bloomberg survey was for an addition of 185,000.

“It’s a very big turnaround from what happened in September to October,” said Evan Lucas, a market strategist at IG Ltd. in Melbourne. “Does that mean December is on? Well, the market has certainly moved to that number.”

December Move

The odds for a December move had dropped as low as 27 percent in mid-October, according to futures data compiled by Bloomberg. The calculation is based on the assumption that the effective fed funds rate will average 0.375 percent after the first increase, compared with the current zero-to-0.25-percent target range.

Hedge funds have gotten better at predicting the direction of Treasuries as 2015 has progressed. Speculators cut net bearish bets to almost zero at the end of June, just in time for the first advance in four months in July. That compares with the biggest net short position since 2010 at the end of December, right before the best advance in 10-year notes since 2011 in January.

As recently as mid-October, traders held a net bullish position. Since then, the Federal Reserve’s Oct. 28 statement said policy makers would reassess the benchmark rate at its “next meeting.”

Fed Chair Janet Yellen reinforced speculation for December liftoff on Nov. 4, calling it a “live possibility.” She speaks again this week, along with New York Fed President William Dudley, Chicago Fed President Charles Evans and Richmond Fed President Jeffrey Lacker.

“Most should sing from the same songbook, cementing expectations for a December hike,” Westpac’s Speizer said.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.