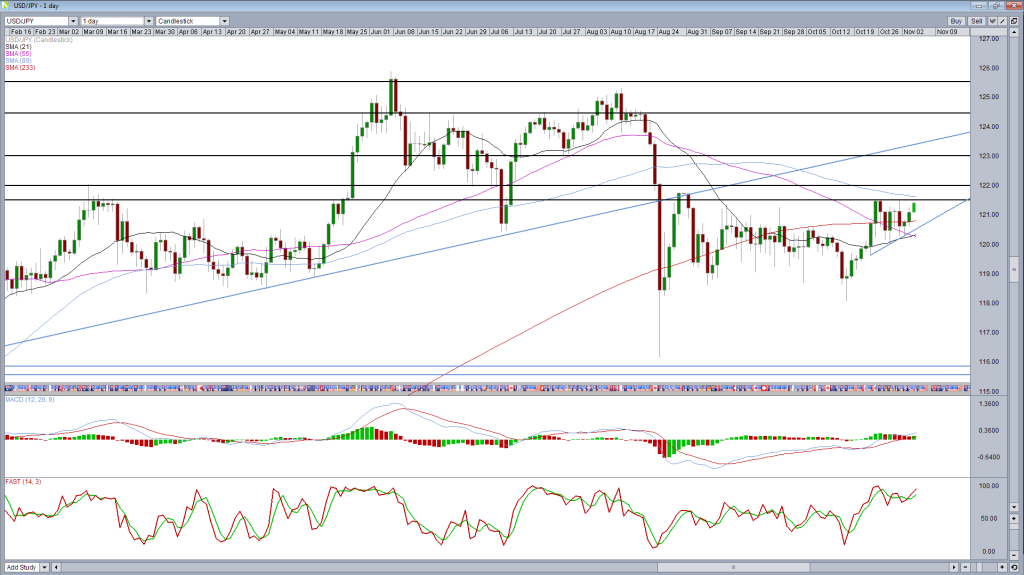

The dollar has been looking increasingly bullish against the yen over the last couple of weeks but continues to face difficulty when it comes to breaking through 121.50.

What’s interesting is that while we have seen numerous failed attempts to break through this level, each time it has failed, the pair has made new higher lows, which suggests the bulls are undeterred.

The ascending triangle that has formed as a result is generally believed to be bullish, whether found in an uptrend or a downtrend.

Once again today, we find ourselves back at the recent highs and trying to break through this well protected resistance level. Given the increasing bullishness each time we see the pair pull back from these levels, I wonder whether this level will continue to be so well protected.

That’s not to say that it’s necessarily going to be broken on this occasions but clearly the bulls are growing in confidence. If we do see a break though this level, the move could be quite aggressive given how well it has been protected until now.

If the pair fails to break through this level again, the triangle support could be a key level, with a break of this suggesting there’s been a momentum shift in the pair and the bullishness is easing.

For now, I continue to focus on the 121.50 resistance level, with both the stochastic and MACD suggesting momentum remains with the bulls.

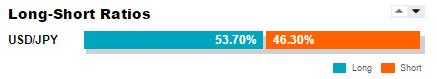

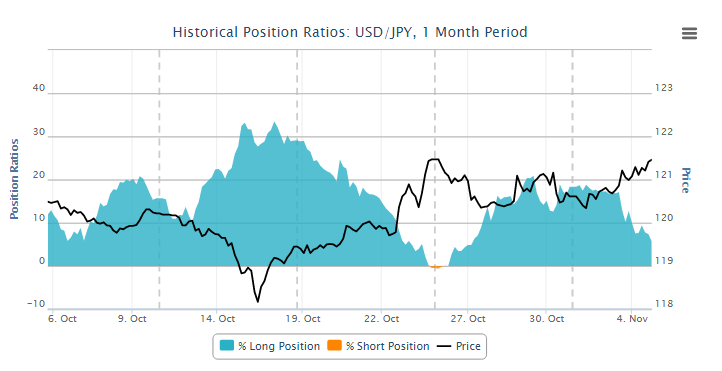

While OANDA net client position is slightly long, it has been becoming less so over the last few days which could actually be a bullish signal given the trend over much of the last month, as per the below chart.

To access the OANDA Open Position Ratios and Historical Position Ratios tools, among many others, visit OANDA Forex Labs.

To access the OANDA Open Position Ratios and Historical Position Ratios tools, among many others, visit OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.