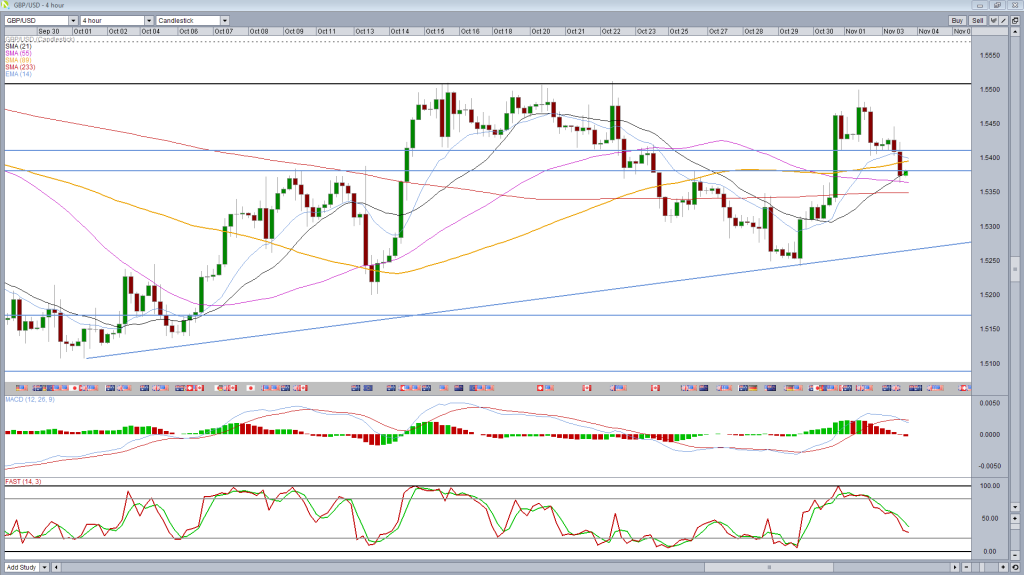

Yesterday I suggested that, having run into resistance around 1.55, a reversal setup may be forming in cable on the 4-hour chart which could point to a consolidation, correction or reversal in the pair (GBPUSD – Potential Bearish Setup at Resistance).

Not only did that evening star formation complete, the pair has sold off since and a bearish pattern could now form on the daily chart which could point to further losses again.

Yesterday’s completed candle is a shooting star, a bearish reversal candle, particularly when found at a known resistance level. On this occasion this is previous highs and the 89-day simple moving average, which has provided support and resistance on a number of occasions this year.

Whether the pair manages to trade above the high of the shooting star the following day can often provide insight into whether or not we are seeing a reversal or not. On this occasion, the pair rallied initially today but failed to make new highs, which suggests we are. Since then the pair has been on the decline.

Now we have a situation in which we could see an evening star formation on the daily chart, which would further suggest that more losses are to come. For this to happen, a close below 1.5350 would need to happen – two thirds of the way into Friday’s candle.

This looks very possible at this stage given that, on the 4-hour chart, we’re seeing no loss of downwards momentum on either the MACD or stochastic.

Below here, the pair could find support around 1.5270 from the ascending trend line – 1 October lows – and 1.5250, the 28 and 28 October lows. A break of these would suggest we’re going to see a move back towards the lower end of the pair’s 6-month trading range, around 1.5080-1.5170.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.