It should be another interesting week in financial markets with a large amount of economic data being released and a couple of central bank decisions thrown in for good measure, including that of the Bank of England on Thursday. The most eagerly anticipated event though comes Friday as the U.S. releases the October jobs report, one of only two that will come before the Fed’s final monetary policy decision of the year.

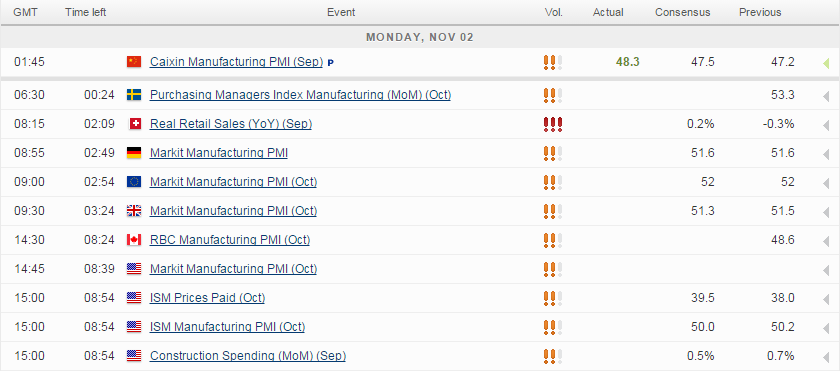

The week gets underway with a raft of manufacturing data from across Europe and the U.S., following China’s lead over the weekend whether both official and Caixin manufacturing PMIs showed the sector remains in contraction. The official PMI showed new export orders contracting for a 13th consecutive month which is consistent with the cooling global growth that we’ve been seeing but the more worrying thing is that the domestic economy isn’t doing enough to pick up the slack. The PBOC recently announced another batch of stimulus measures but with the data continuing to point to slower growth, more is likely to be needed.

The manufacturing PMIs from Europe aren’t likely to make for much better reading today, although they do at least suggest the sector is experiencing growth, albeit weak and from a low base following a very tough period for the eurozone.

Manufacturing in the U.K. has been cooling for some time now and continues to face difficulties including sluggish growth in the eurozone – the U.K.’s largest trading partner – and the strong pound which makes them less competitive. We saw in the last quarter that along with construction, manufacturing was a drag on the economy and today’s release – seen falling to 51.3 from 51.5 – suggests that is unlikely to change. With the Bank of England still exploring the possibility of a rate hike as well which could strengthen the pound further, the manufacturing industry may continue to face strong headwinds.

The story is expected to be very similar in the U.S., which has also experienced a significant slowdown in the sector over the last year. In fact, the PMI reading is expected to have fallen to 50 which suggests the sector has experienced no growth. While this is likely to weigh a little on the U.S. economy, it is worth noting that as in the U.K., the manufacturing sector is quite small in the U.S. and is therefore unlikely to be a major drag.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.