It’s been another interesting week for the markets in which central banks have once again played a starring role, setting U.S. up nicely for what is likely to be a frantic run up to year end. The two in focus today will be the European Central Bank and the Federal Reserve as we get the latest inflation data from the U.S. and the eurozone.

Inflation in the euro area fell back into negative territory last month, almost a year after the ECB began its bond buying program in order to tackle that very situation. A year on and the ECB is once again exploring its options and is widely expected to announce its latest easing measures in December.

While inflation is expected to move back out of negative territory this month, zero inflation is still well below the ECBs 2% target and even core prices are lagging well behind at 0.9%. I think it’s clear now that the ECB is going to respond in December and the inflation data could determine how strong its response is. More deflationary pressures between now and December could force it into another significant easing with it even being suggested that both a rate cut and more bond buying could be considered.

The Fed is facing similar problems but a whole other dilemma in that inflation is also well below target and yet it is preparing to raise rates and all other economic indicators don’t justify the kind of emergency monetary policy that is currently being adopted.

The core personal consumption expenditure price index – the Fed’s preferred inflation measure – will be released this afternoon and is expected to show the biggest monthly increase since last November. While this could be seen as a step in the right direction, justifying the Fed’s decision to push ahead with tightening plans, in isolation we couldn’t really read too much into this. It could just be an anomaly and instead would make the next couple of months of data all the more interesting.

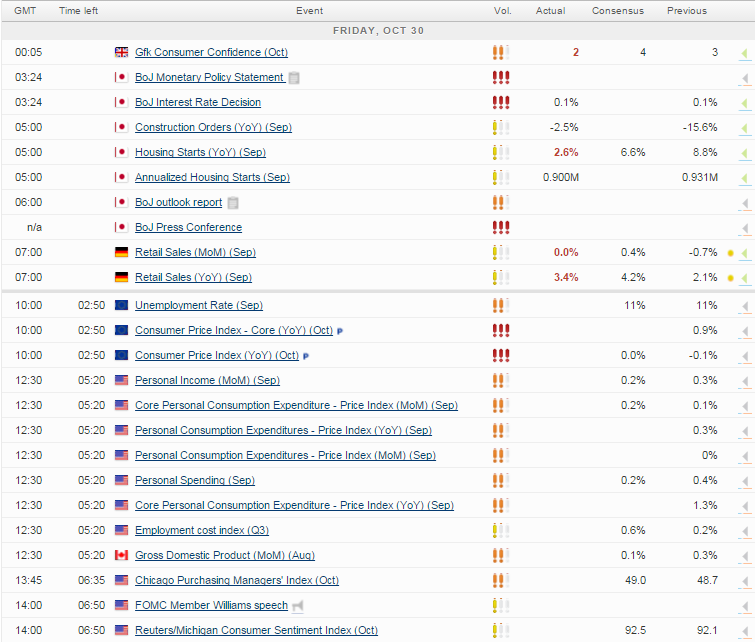

We’ll also get personal income and spending data from the U.S. this afternoon, both of which could hold the key to future inflationary pressures. As will the employment cost index which offers key insight into whether companies could begin to raise prices for consumers in order to cover increased costs. We’ll also get the revised UoM consumer sentiment reading to cap off the week.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.