Many European indices are expected to open around half a percentage point higher on Thursday following what was a mixed reaction to the Federal Reserve’s statement yesterday evening. The statement was undoubtedly more hawkish than before and put December well and truly back on the table and investors didn’t really know how to take this.

U.S. indices initially fell into negative territory for the day having traded almost 1% higher prior to the release, but it wasn’t long before they erased these losses and ended the day more than 1% in the green. The problem is that unlike the European Central Bank, the Fed doesn’t appear to be even trying to send a clear message to the markets. It’s afraid to commit either way but saw that the markets has priced out a hike far too much and wanted to balance things up again in case it does decide to move in December.

I think when it comes to it, the markets will be able to cope just fine with a rate hike as it will suggest that the economy is recovering well and showing strong resilience at a time when other countries are really struggling. The problem for now is that in balancing things up again, the Fed has just created more uncertainty in the markets and that would suggest why the markets dipped into the red shortly after the statement was released.

This leaves U.S. in a position once again where the markets are going to be very sensitive to U.S. data, the first of which comes today with the advanced reading of third quarter GDP being released. Growth is widely expected to have cooled in the third quarter to 1.6%, with the growing trade deficit weighing on the number. If the Fed raises at the same time as other central banks ease, as they are expected to, this could make that problem even worse next year and make life even harder for U.S. exporters.

This morning we’ll get a bunch of data from the eurozone such as unemployment and preliminary CPI data from Germany, consumer credit data from the U.K. and flash CPI data from Spain. The euro has come under intense pressure over the last week after the ECB strongly hinted at further easing in December and weak data from the region, particularly inflation data, should weigh heavily on it again in the weeks ahead as it only increases the likelihood that the central bank will act in December.

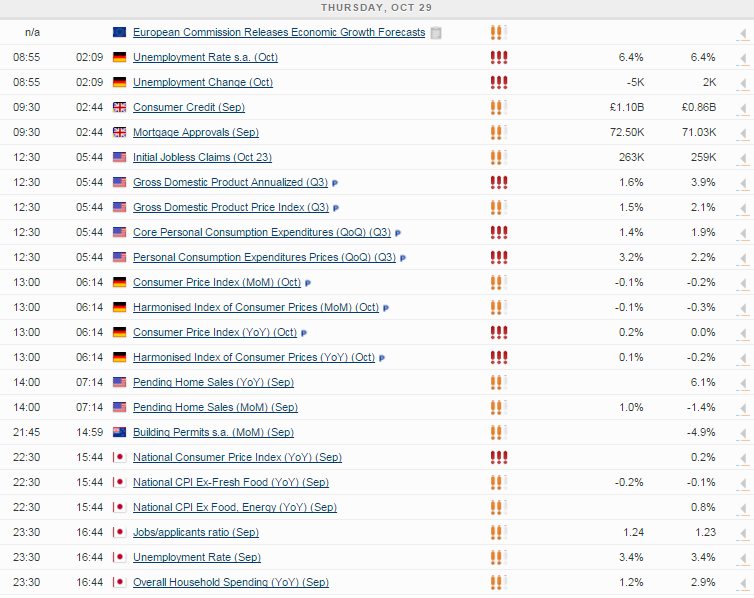

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.