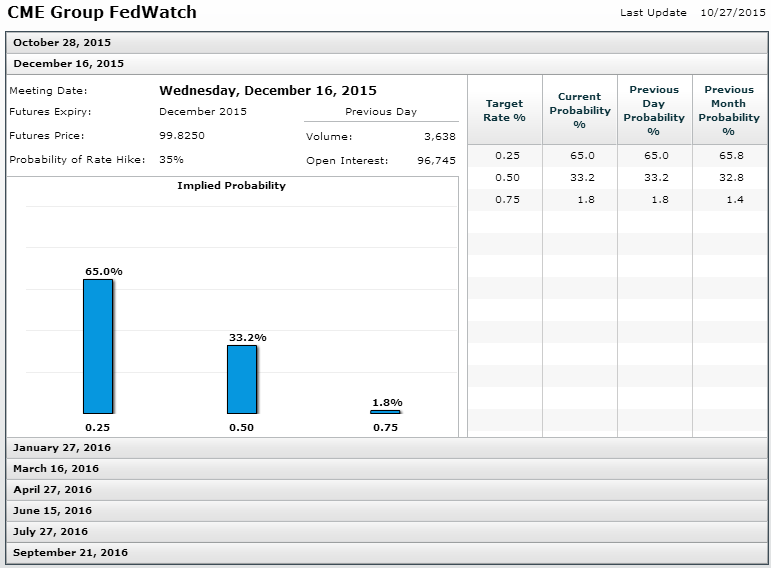

Investors are likely to be operating with an element of caution on Wednesday ahead of the Fed’s latest monetary policy announcement this evening, the penultimate one of the year that should leave little doubt about when rates will finally rise. For months the Fed has repeatedly stated that it remains committed to raising rates this year and yet it has failed miserably to properly communicate that to the markets that have priced in only a 35% chance that it will happen this year.

Source – CME Group FedWatch Tool

The unfortunate truth is that so far, under the leadership of Janet Yellen, the Fed has sent very mixed messages that rather than provide clarity and transparency, have left U.S. more confused than we’ve ever been. It’s clear that this decision is not straight forward but the Fed has failed to send a clear message and in the opinion of many, not including myself, has missed the opportunity to begin the tightening process.

There is clearly a lack of consensus among the policy makers at the FOMC at that is coming across in the Fed’s releases. It constantly talks up the labour market and need for a hike this year but at the same time, the need for more to be done, the worsening inflation outlook and threats coming from a slowdown in emerging markets. It’s no wonder that people are confused and therefore see this as evidence that the Fed can’t hike this year.

The problem is, the markets have been caught out before and will be again so we can’t just assume they are correct, despite what is currently priced in. A bigger problem is that this is the Fed’s last opportunity as a collective to convey a clear and consistent message that will then be priced in to the markets so as to avoid any shocks in December, which it will be keen to avoid.

If it fails again, it may have backed itself into a corner and may be forced to delay the rate hike again. If it intends to do this anyway, it should communicate this clearly. This is the problem with not holding press conferences after every decision, this is a lot to achieve in a single statement without creating any further confusion.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.