We have reached the penultimate FOMC decision of the year and despite the Federal Reserve’s constant insistence that rates should rise this year, the market is becoming increasingly confident that it won’t happen, which suggests there is a massive problem in the central banks communication strategy. Investors have been doubting the Fed’s position for a while and the softening in the data in the last couple of months has only increased the belief that rates won’t rise.

At the last meeting in September the Fed was presented with an issue in that emerging markets had experienced excessive amounts of volatility and selling which could create problems at home. Rather than be rushed into a decision the Fed understandably opted to wait and see how events developed and what impact they have on the US economy. Unfortunately they now face potentially bigger problems as many important economic data releases have pointed to a cooling in the economy, although it’s not yet clear whether this is a temporary blip or something more permanent. After all, there’s only been a couple disappointing labour market reports and much of the year has been good.

Clearly they could just wait and see how this pans out and make a decision in November but that doesn’t help with the messaging today. With this being the final meeting before December, no press conference taking place after and the market betting against a rate hike this year, this is the Fed’s final opportunity as a collective to send a clear message. Either they are planning to hike in December or recent events have forced them to hold off until next year. Whatever they opt for, the statement must convey the Fed intentions clearly.

If they insist on sending another message like those from previous meetings, they will be in a position come December in which the market has bet so much against them that they are either forced to wait or cause havoc. This can be avoided today but unfortunately, Chair Janet Yellen hasn’t so far proven herself capable of forming any real consensus within the Fed and that has been reflected in the markets. Now her job is arguably more difficult than it has been at any other point this year and she must step up and provide the kind of transparency that the Fed prides itself on.

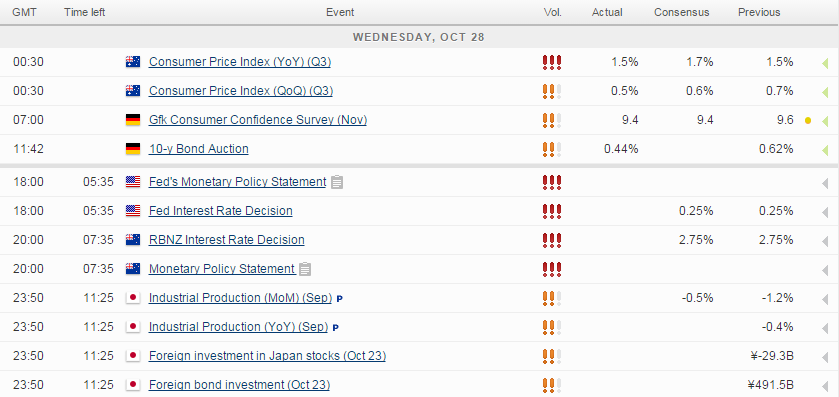

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.