Disappointing data has reduced probability of U.S. rate hike until December

The first economic indicators out of the U.S. this week both disappointed painting a pessimistic view of the upcoming Federal Open Market Committee (FOMC) rate decision and statement tomorrow. The U.S. core durable goods was expected flat and it posted a negative 0.4 percent change in September. The outlook for the U.S. economy got cloudier as the consumer confidence index was reported below forecasts at 97.6 for October. Economists were anticipating a reading of 102.8, but did not account for the short term pessimism from consumers.

The market consensus is pointing towards the Fed not raising rates in October, but given the flak aimed at the central bank a more communicative approach might be taken by American policy makers. This could mean a concrete answer to the timing of the rate hike. The USD has struggled against majors as the Fed’s easing intent is not clear. Other central banks have used rhetoric to signal further monetary policy and in the case of the European Central Bank (ECB) an increase to their quantitative easing program as deflation and the Fed’s lack of commitment has forced their hand.

The U.S. Federal Reserve will publish the FOMC statement and rate announcement on Wednesday, October 28 at 2:00 pm EDT. The October FOMC is not followed by a press conference so investors will receive no further guidance until the minutes from the meeting are released in two weeks.

October FOMC Not Expected to Bring Surprises

The Federal Reserve seems to have talked itself into a corner regarding the timing of the first rate hike. Communication is at the heart of the problem. Ever since the Taper Tantrum, which was spearheaded by Janet Yellen, the American central bank has struggled to communicate clearly its intentions to the market. There was almost no transition as the Fed abandoned forward guidance and started using data dependency as a way to set expectations.

The June and September FOMC meetings have come and gone, and with them two solid candidates for a rate hike. Global economic conditions have changed and the U.S. recovery is in question if the speed of the headwinds escalates.

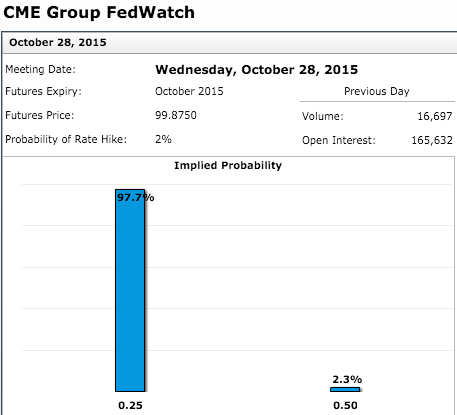

The CME Group Fed Watch calculates the probability of a change in the benchmark rate by using the future contract prices. The more the Fed has communicated with the market via rate statements the more the probabilities of sooner rather than later have evaporated. October has always had a lower probability given the fact that it does not have a press conference following the release of the statement. October has a 2.3 percent probability of a rate hike, while December improves with a 31.9 percent.

ECB’s Draghi Boosted USD with Easing Rhetoric

The EUR/USD has depreciated since the ECB monetary policy meeting and press conference on October 22. The pair fell 2.89 percent after ECB president Mario Draghi shocked markets by revealing the central bank is ready to cut rates and increase the size of its record quantitative easing program to escape falling into deflation. The EUR fell as the words from the ECB were weighted against the noncommittal language of the Federal Reserve’s FOMC statements and minutes.

The Bank of Japan is another central bank expected to make waves at the end of the week as all the momentum from Abenomics seems to have eroded. An increase in stimulus from China, Japan and Europe is putting less pressure on the Fed to make a move as the U.S. recovery is facing an uphill struggle after a string of indicators have been disappointing and question if the Fed’s patience was calculated or if they simply waited for too long.

The Bank of England hedged the possibility of a U.K. rate hike this weekend with his statement that higher rates are not a guarantee. A possibility not a certainty is how the BOE Governor put it in a written statement. Similar to the U.S. the minutes from both central banks show one vote for higher rates versus the vast majority against.

Central banks after unshackling market volatility are having trouble boosting growth and have gone back to their monetary policy bags of tricks. The Federal Reserve is losing support from strong economic indicators as it approaches the end of the year. As BOE’s Carney mentioned: a rate hike is a possibility, not a certainty. Fed Chair Janet Yellen cannot directly improve the state of the U.S. economy, but she can exert her influence in improving the transparency of the central bank’s communication with the market.

USD events to watch this week:

Wednesday, October 28

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

Thursday, October 29

8:30am USD Advance GDP q/q

8:30am USD Unemployment Claims

Friday, October 30

8:30am USD Employment Cost Index q/q

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.