Eurozone Services Sector Picks Up Manufacturing Slack

It’s been a good start to the European session on Friday, with the encouraging eurozone PMI readings compounding the bullish sentiment on the back of Mario Draghi’s monetary stimulus hint in yesterday’s press conference. While a further dose of stimulus in December is obviously not guaranteed, the suggestion from Draghi was quite clear and the fact that a few members were inclined to ease this month only increases the likelihood of it. It’s very clear what investors thought of the comments, with the euro sliding and German yields on 2-year debt hitting record lows, well into negative territory. This stimulus offers a boost at a welcome time, given the ongoing concern about a Chinese slowdown and the drag that emerging markets could have on global growth.

The PMIs alluded to these issues with the growth in manufacturing slowing, an expected result of the slowdown in China with it being an important trade partner for the euro area, particularly Germany. German manufacturing is now suffering on two fronts, with exports to China and Russia coming under pressure, the latter due to a weak economy and sanctions. Fortunately the services sector seems to be making up for the slowing growth in manufacturing which will enable the eurozone to continue its recovery, albeit quite a mild one. The employment aspect of the report was also encouraging although given the high levels of unemployment in the region, we will need to see this accelerate much more.

Slowing US Manufacturing Growth Trend Seen Continuing in October

It’s now over to the US to see how the manufacturing sector is performing, with expectations currently being for growth to slow slightly. Slowing global growth is likely to continue to weigh on demand for US exports, especially given that exporters are still contending with a strong dollar. While we saw a slight pickup last month, the trend remains towards slowing growth in the sector, which is likely to continue in October.

EURUSD

We’re seeing consolidation in the pair today after the euro suffered heavy selling on the back of Draghi’s December stimulus hint. As it stands, there doesn’t appear to be much appetite for a larger correction but if we do see one, 1.1220 could be key as this is roughly the midpoint of yesterday’s open and closing levels. A failure to break above this level could be seen as confirmation of the initial move and suggest the pair is going to build on yesterday’s move. Given that we’ve seen the pair push below the September lows, I think we could see a more protracted move to the downside in the coming days and weeks and the May and July lows around 1.08 strikes me as the next clear support for the pair.

EURGBP

Yesterday’s decline was also very strong in EURGBP, helped by the strong UK retail sales data which compounded to drive the pair back to September’s lows, around 0.72, where the pair is currently finding support. Given the fundamentals of these two currencies, it’s difficult not to see further declines coming. If the UK continues to see strong wage growth and consumer spending, people are going to be forced to bring forward their rate hike expectations which should strengthen the pound.

Yesterday’s candle was a marabuzo candle and therefore the midpoint – 0.7285 – could prove to be key if we do see a bigger move to the upside, although as it stands all we’re seeing is consolidation. If we see Septembers lows broken in the coming days, the next key test for the pair should come around 0.7150, with a break of this level potentially opening up a move back towards 0.70.

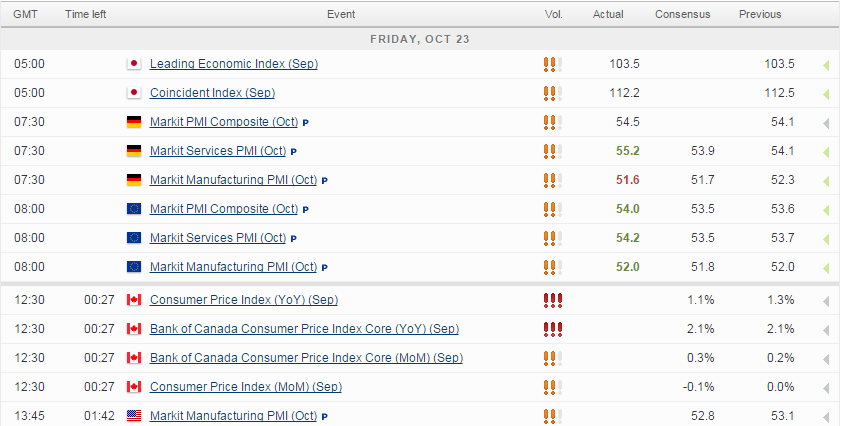

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.