Japan is at risk of falling back into recession in the third quarter and today’s trade data did nothing to suggest that this would be avoided. The Asian market proved particularly troublesome for Japanese exporters in September, particularly China where exports fell 3.5% compared to last year.

The Asian market could continue to be challenging for Japanese exporters given the slowing growth in the region. If the country does fall back into recession in the third quarter it will make the job of returning inflation to 2% even more difficult and could pursued the Bank of Japan to consider further stimulus. It may well be this that spurred the Nikkei to outperform the Asian markets overnight, the prospect of more monetary stimulus as the economy faces the prospect of another recession.

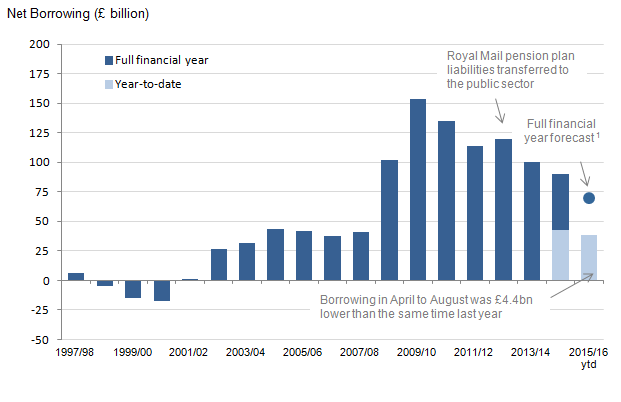

European indices are currently seen tracking these small gains in much of Asia, when they open this morning. We’ll get the latest look at the UK public finances this morning and we’re expecting to see a decline in borrowing compared to last month surprise spike. Overall, public finances are continuing to improve and borrowing of £9.1 billion last month should leave the UK on course to wipe more off the deficit again this year, although the job will only be half done if this is achieved. If the government hits its target, the deficit will have fallen just over half compared to its peak in the year ending March 2010.

Source – ONS Summary of Public Sector Finances, August 2015

This afternoon we’ll get the latest crude inventories data which could spark further interest in crude. We’ve seen inventories build for the last three weeks now which has helped ensure oil prices remain quite heavy. Another build today, 3.5 million barrels expected, could add further downside with WTI currently appearing to eye September lows having broken through some technical support levels in the last couple of days.

For more on WTI Crude, check out our latest technical analysis (WTI – Bears Take Another Stab After Fakeout).

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.