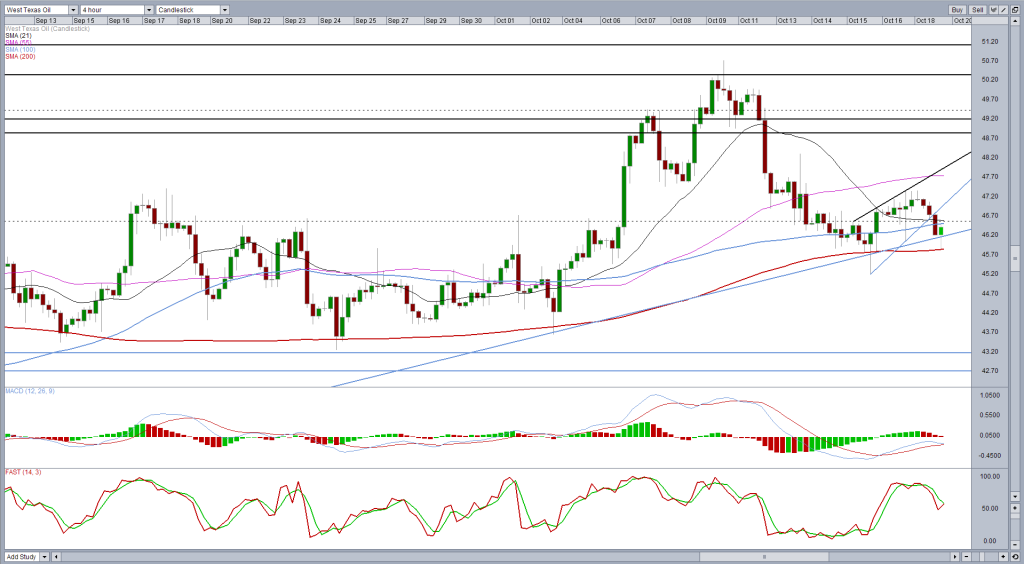

WTI has been in consolidation over the last couple of days after failing to close below the ascending trend line on Thursday, despite initially breaking through in what turned out to be a fakeout.

A failure to rally strongly off the back of this move suggested that the market remains bearish on WTI, as highlighted on Friday (WTI Crude – False Breakout Not a Bullish Signal). The consolidation that we were seeing created a rising wedge – a bearish continuation pattern – and today we have seen the trend line support broken.

This has been followed by some strong selling and one again, the ascending trend line – 24 August lows – has come under pressure. While it is currently finding support at this level again, the key difference on this occasion is that the move isn’t being made on declining momentum, which may suggest a legitimate breakout will occur.

Given that we’ve already seen one fakeout, I would prefer to see some confirmation of the move, preferably a daily close below the trend line, but early signs are bearish. If we see a close below here then, as stated previously, the September lows around $42.70-43.20 will be key.

The 200-period simple moving average on the 4-hour chart may also offer clues with it having been a notable support level over since the start of September.

If we fail to see a close below then I will be back in wait and see mode. Nothing I have seen so far makes me doubt the bearishness of the charts but I will be monitoring them for signs that the bulls are pouring back in, which may come following another failed break.

The current 4-hour candle is shaping up as a hammer at the moment, which is one bullish signal but alone it doesn’t change my view. If it is followed by a move above Friday’s highs, it may be time to reassess.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.