Europe is expected to open on a more positive note on Thursday following a positive session in Asia overnight, where investors were boosted by rising expectations that the Federal Reserve won’t raise interest rates this year.

Yesterday’s retail sales report was just the latest to cast serious doubts over the strength of the U.S. recovery at a time when the Fed is struggling to convince the markets that now is the time for a rate hike. Weak numbers for September and downward revisions for August delivered another double blow to the Fed, you have to wonder how long it will be before the knockout punch is finally landed.

The Fed has remained resilient until now and continued to stress that this remains a transitory period but the markets are not buying it and we continue to see weak data. We need to see a turnaround in the next couple of months or the Fed will inevitably be backed into the corner. Already Fed Funds futures are pricing in only at 32% chance of a rate hike this year so either the Fed needs to get on board with this or start communicating much better.

Investors in Asia are clearly hoping for the former having suffered considerably this year as a result of the pending rate hike from the Fed, among other things. The rally overnight clearly reflects a belief that the retail sales report dealt a serious blow to rate hike expectations and combined with other report, such as the poor employment figures, could prompt a softening in stance when it meets in a couple of weeks.

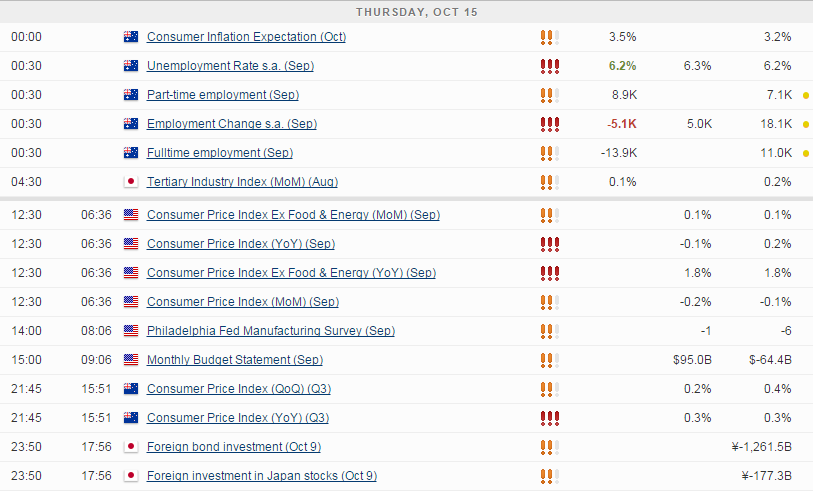

With no data due from Europe today, attention will be primarily on the U.S. again. The CPI inflation report, despite not being the Fed’s preferred measure, will be the one that everyone will be monitoring closely today and could deliver yet more punishment to rate hike hopes. A triple whammy of weak report – jobs, retail sales and inflation – would not make for easy reading for an already somewhat divided Fed in a couple of weeks. It looks like this is exactly what it’s going to get, with expectations being for a 0.2% decline in price last month and core inflation only rising by 0.1%.

We’ll also get a couple of manufacturing surveys survey’s – Philly Fed and Empire State manufacturing index – both of which are expected to point to further deteriorating conditions in the sector. The Empire State reading is expected to show a third, albeit improving, month of contraction and the Philly Fed a second. Once again, this doesn’t make for good reading for the Fed. Jobless claims data will also be released and should be a small bright spot, with only 269,000 new claims last week.

Finally crude oil inventories data will be released later on this afternoon and given the weakness in WTI over the course of this week, this could be a very interesting report. Another small build – third in a row – of 2.2 million barrels is expected which could apply further pressure to the price, which already looks likely to edge back down towards $43 in the short term.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.