The pound fell to a five-month low against the dollar last week in what may have been a sign of further losses to come.

However, this was followed by a woeful US jobs report on Friday that brought about some broad-based weakness in the dollar and prompted a recovery in the pair.

It has now rallied back to a level which could provide some insight into whether this rally is just a temporary retracement of continuation of the range bound trade that the pair has found itself in since May.

Today, the pair has run into resistance around 1.5320 – 38.2% retracement of the move from 18 September highs to 1 October lows – which roughly coincides with a prior support level.

Just above here we have the 233-day simple moving average which hasn’t necessarily been a reliable level of support and resistance in recent months (tends to be the case in sideways market), but may be so if it is moving back into a downtrend.

Alone this may have not have been too reliable, as we are still in sideways trending market, but the fact that it coincides with the 50 fib level means it could prove to be an important level of resistance.

If price fails at either of these levels it would suggest that the recent rally may just be temporary and be a bearish signal and prompt another test of last week’s support. A break of this would be quite bearish.

A break above these resistance levels, on the other hand, would suggest the pair remains range-bound.

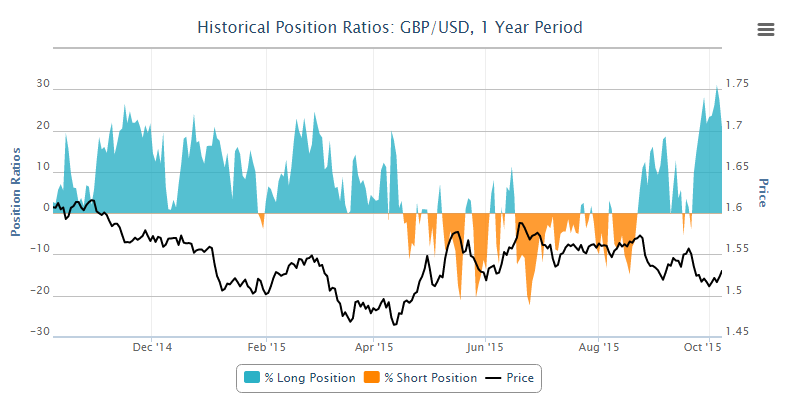

The above statistics came from OANDA fx Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.