Next week the U.S. will release three important employment indicators.

After a disappointing September FOMC that did not bring the much-awaited first interest rate hike came a round of contradictory statements by Fed members that culminated with Chair Yellen trying to clear the intentions of the central bank regarding inflation and interest rates a put a 2015 interest rate hike firmly on the table. The week of September 28 to October 2 will bring three major American employment releases.

The ADP private payroll report will be published on Wednesday, September 30 at 8:15 am EDT, the weekly unemployment claims will be released on Thursday, October 1 at 8:30 am EDT and finally the biggest event of the week will be on Friday, October 2 at 8:30 am EDT when the Bureau of Labor Statistics releases the September non-farm payrolls report (NFP).

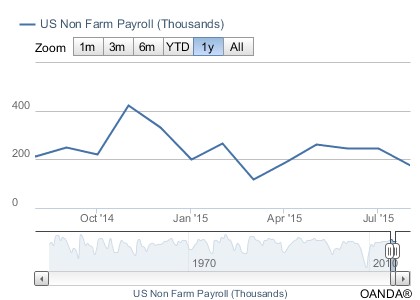

The USD strength has waned as economic data posts positive numbers, yet the Federal Reserve has failed to commit to a clear rate hiking schedule sowing uncertainty and triggering volatility. The NFP is expected to announce 200,000 new jobs, but at this point it remains to be seen if that is enough for the Fed.

Forex market events to watch this week:

Monday, September 28

8:30am USD FOMC Member Dudley Speaks

Tuesday, September 29

8:30am USD Goods Trade Balance

10:00am USD CB Consumer Confidence

Wednesday, September 30

4:30am GBP Current Account

8:15am USD ADP Non-Farm Employment Change

8:30am CAD GDP m/m

3:00pm USD Fed Chair Yellen Speaks

9:00pm CNY Manufacturing PMI

9:45pm CNY Caixin Final Manufacturing PMI

Thursday, October 1

4:30am GBP Manufacturing PMI

8:30am USD Unemployment Claims

10:00am USD ISM Manufacturing PMI

9:30pm AUD Retail Sales m/m

Friday, October 2

4:30am GBP Construction PMI

8:30am USD Non-Farm Employment Change

8:30am USD Unemployment Rate

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

ADP Could Beat Lower Forecasts

The ADP private non farm payrolls have missed expectations for two consecutive months. Last month’s private jobs gains were 190,000 when 204,000 was the forecast. The overall trend is still positive and the two year monthly average is above 200,000. The data provided by the payroll company ADP does not correlate 1 to 1 to the government’s non farm payroll report (NFP) published by the Bureau of Labor Statistics, but at the moment they both reflect a strong recovery in American jobs.

This months ADP payrolls are anticipated at 191,000. Forecasts have been adjusted after the missed expectations of the previous months. Anything above expectations will be positive for the U.S. dollar with the caveat that it might not fully predict the more important NFP figure release on Friday.

Unemployment Claims Point to Jobs Recovery

The number of individuals who filed for unemployment insurance for the first time in the U.S. has stayed close to estimates. The year to date weekly average of new unemployment claims is 284,800. Last week’s release was 267,000 new claims versus an expected 268,000. The lower than 300,000 weekly average and the downward trend point to a resilient job market.

US Employment Unable to Convince Fed on Rate Hike

Employment has always presented the Federal Reserve a perfect example of the American economy recovery after the crisis. Steady gains in the number the jobs and a low unemployment rate have boosted the USD as an interest rate hike could not happen without either. In order to calm the market’s excitement as the headline employment figures recovered perhaps ahead of schedule the Fed introduced a more nuanced analysis. Monetary policy would depend on data, not just headline data. This introduced a more in-depth review of the components of American jobs which are mixed. Wages have not increased as much as the Fed would want them, putting no pressure on inflation. Labor participation is a delicate subject as there seems to be more jobs, yet people are being forced out of the workforce.

The August NFP was broadly expected to miss the mark as the end of the summer always leads to late submissions that are only added to the revisions a month later. Last month we published a note on the finding of a study in Reuters:

Reuters published an analysis of the past 10 year data and in a development that complicates the probability of the Federal Reserve announcing a rate hike in September, the NFP data in August tends to be weaker, with a likely upwards revision a month later. On average 58,000 more jobs were added after the deadline as companies turned in their questionnaires late.

As outlined in the analysis the August NFP was indeed lower than expected. The expectation is for the September numbers to bounce back after the summer doldrums and a healthy revision to the missed forecast in August.

The NFP report has narrowly missed forecasts in the months leading up to August, but revisions play an important part and the last two changes have been upward. The revisions to the numbers release last month will also be mentioned alongside the newly released figures. The market did not sell the greenback with the last release of NFP as it was well understood the reasons for its underperformance. The NFP released on Friday, October 2 at 8:30 am EDT will not get the same benefit with its forecast of 202,000 new jobs. It should be no problem to break 200,000 as only the data released in August was unable to break above that number since April this year and September of 2014.

A strong NFP will put further pressure on the Fed. So far Chair Yellen and FOMC voting members sound hawkish individually with the majority saying a rate hike before the end of the year is a strong possibility. Yet as a group there is a strong dovish tone to the FOMC statement. There was only one dissenter in the last meeting voting for a rate hike. The Fed has included language to explain its decision to hold rates attributing it to macro events outside American borders.

The Fed has also hedged that statement by adding that those events have not changed the fundamental course of monetary policy. This is also common knowledge, but at this point the Fed’s data dependency has trigged a timing dependency in the market. The timing of the rate hike has become more important that the rate itself in the short term creating undated volatility. The Fed has a chance to calm markets by adding transparency but has only offered contradictory statements and an unwillingness to commit.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.