Investor sentiment has been dealt another blow on Wednesday after the China Caixin manufacturing index slipped to a six-and-a-half-year low, fuelling Chinese growth fears at a time when concerns are already quite elevated.

The decline in the PMI reading to 47 from 47.3, well below 50 which separates growth from contraction, was driven by a decline in new orders and new export orders sub-indices which fell to 46 and 45.8, respectively. Falling demand both domestically and abroad is only going to make the task of achieving 7% growth that much harder and in fact, there has already been a number of revisions to Chinese growth forecasts this year.

The latest revision came from the Asian Development Bank, which now expects China to grow by only 6.8% this year and 6.7% next. While the government and People’s Bank of China both have plenty of capacity to provide further stimulus, efforts so far only appear to have slowed the decline rather than stop it which suggests the tide they’re swimming against is more powerful than first thought. I don’t think this is the last downward revision we’ll see to growth this year and if China is going to achieve growth even close to 7%, we’re going to have to see stimulus measures finally feed through to the real economy.

With Chinese manufacturing activity cooling again this month, we could see commodities underperforming again today, weighing further on European indices which are expected to open around 1% lower after suffering heavy losses yesterday.

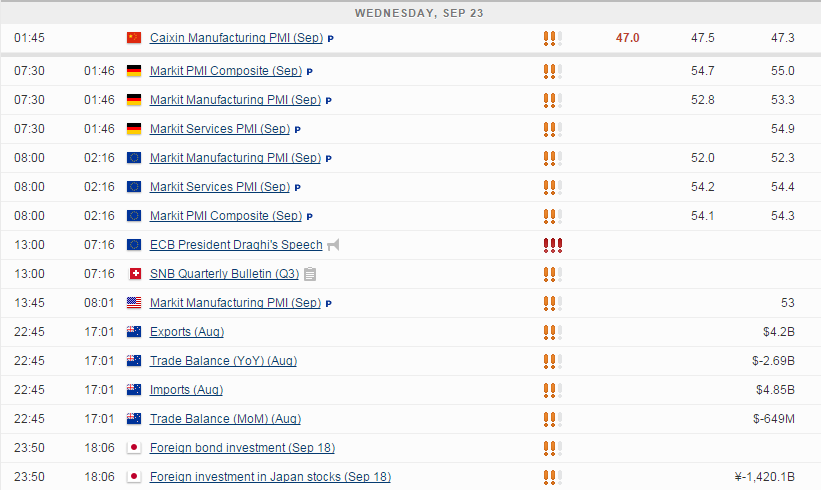

Traders may now look to manufacturing and services PMI data from the eurozone, Germany and France to provide further direction this morning. The German and eurozone readings are expected to decline slightly but remain comfortably in growth territory for the month. Given the exposure to China and other emerging markets and the amount of volatility and uncertainty over the last month, this is to be expected. If we can only see a limited decline in these readings, it could actually be viewed as a small positive as we know how fragile confidence in the euro area already is.

Mario Draghi, European Central Bank President, will testify on monetary policy before the European Parliament’s Economic and Monetary Committee this afternoon, which could provide great insight into whether the central bank is contemplating expanding its bond buying and if so, when.

The eurozone continues to experience extremely low levels of inflation and unemployment is very high so the inflationary pressures that may eventually arise elsewhere are likely to elude it for some time. While the euro is back at around 1.11, it has found support over the last month or so, trading as high as 1.17 at once stage, which could provide additional deflationary pressures, forcing the ECB to act.

Later on we’ll also get more data from the U.S., with the flash manufacturing PMI data for September being released as well as the latest crude inventories number for last week.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.