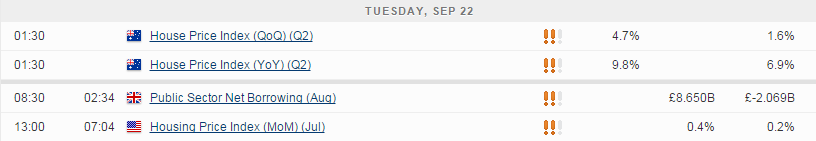

We’re expecting a mixed start to the European session on Tuesday as traders eye the latest U.K. public finances data and speeches from members of the Federal Reserve and Bank of England.

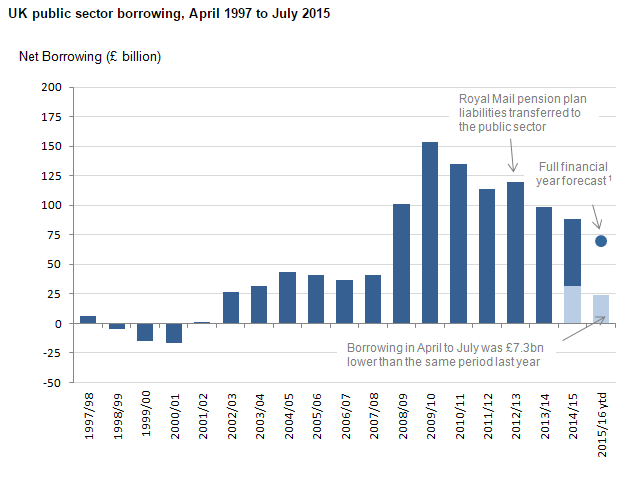

U.K. public sector net borrowing in August is expected to stand at £8.65 billion in August after achieving a small surplus the month before. Borrowing this fiscal year is on course to fall again from last year, having declined by more than £7 billion up until July.

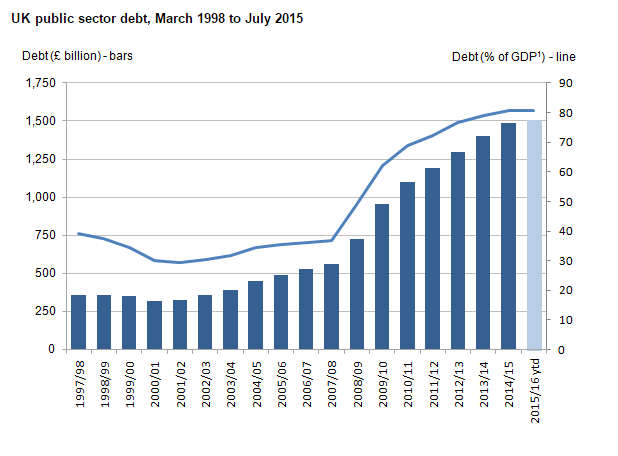

Source – ONS Summary of Public Sector Finances July 2015

Higher tax receipts are contributing largely to this as the economic recovery continues at a strong pace and unemployment falls further. Wages are now also improving which should contribute to this as long as the trend remains sustainable.

While this is a quieter week for data, there are a lot of central bankers speaking, particularly from the Fed and BoE, both of which are currently contemplating rate hike. The Fed’s decision not to hike last week did not get the positive reaction in the markets that we may ordinarily have expected which suggests that aside from being priced in, there may now be a willingness for the Fed to just get it out of the way.

There’s already been a number of speeches this week and the message has been broadly similar, that rates are still expected to rise this year. Today we’ll hear from FOMCs Dennis Lockhart again, as well as the BoE Deputy Governor Nemat Shafik.

Alexis Tsipras was sworn in as Greece’s Prime Minister on Monday, returning following an election in which Syriza was given a bigger vote of confidence than opinion polls suggested. The party was just short of an overall majority, forcing it back into coalition with small right wing party, the Independent Greeks.

The new coalition government now has a massive job on its hands if it is to implement the conditions of the third bailout in a timely manner. The first review of the bailout takes place next month which doesn’t give them much time. Tsipras’ first priority will be making the country’s debt more sustainable which its creditors are willing to discuss and the International Monetary Fund has insisted on in exchange for its participation.

As EU treaties don’t allow debt forgiveness, Greece is likely to achieve this through extended grace periods and lower interest rates on its current debt, while a cap is also likely to be applied to debt-servicing each year at 15% of GDP.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.