The Fed Faces its September Rate Meeting Under Pressure to Raise Rates

The Federal Reserve is on the verge of raising American benchmark interest rates for the first time since June 2006. The U.S. economy has climbed out of a recession and after announcing in the summer of 2013 that it would end its quantitative easing program it is now facing the real possibility of raising the Fed funds rate. There has been little guidance from the U.S. central bank on when the decision will come as FOMC meetings have come and gone without a rate hike.

Chair Janet Yellen has not been a straightforward communicator compared to her predecessor Ben Bernanke which is making investors unsure of what or when the next step from the central bank will be. Domestic reasons such as the disappointing Q1 results and the uneven recovery forced the Fed to decide against a rate hike in June. Now global events such as the slowdown in China could derail a September rate hike forcing the Federal Reserve to reschedule towards the end of the year or into 2016. The problem with a “data dependent” decision is that the data has been mixed and the Fed has not committed to transparency by setting a clear schedule. Financial institutions, academics and investors are all divided on what the Fed’s next step will be which is driving market volatility.

The Federal Open Market Committee (FOMC) will release its economic projections and rate statement on Thursday, September 17 at 2:00 pm EDT. Chair Yellen will talk to the press at 2:30 pm to provide further insights into the Fed’s announcement.

Fed policy members have been divided in their comments, which has added confusion to what the market expects from the central bank. It is a fact that the post crisis recovery has arrived, but it is an uneven recovery. The number of American jobs has increased, but it is the quality of those jobs that is in question. Wages have not risen and the lack of consumer spending shows the jobs don’t afford Americans enough disposable income. Retail sales are recovering at a slower pace with various setbacks but alone do not justify higher interest rates.

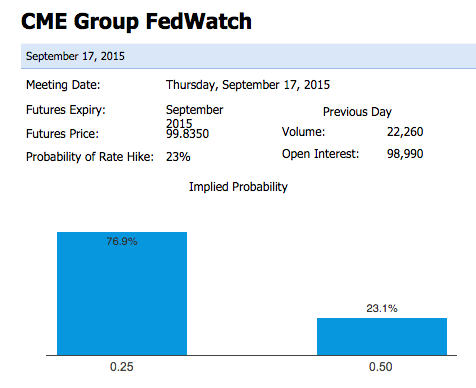

CME FedWatch Shows 23.3% Probability of a Rate Hike in September

The Chicago Mercantile Exchange (CME) 30-Day Fed Fund futures prices have been pooled to get view of market sentiment on what the likelihood of a change in the benchmark interest rate. The probability of a rate hike in the next FOMC meeting as of September 16 has dropped to 23 percent from 24 percent a day earlier. October is higher at 35.5 percent. December and January meetings are over 40 percent. Read more on how the CME calculates the probability here.

September’s FOMC remains the best chance for the Fed to start a tightening cycle without triggering too much volatility in the market. Volatility is inevitable, even as this much-awaited event comes to pass. A disappointing first quarter destroyed the June FOMC chances of being the chosen meeting to start raising interest rates. In hindsight given how those GDP numbers were revised and the economy bounced back, it would have made more sense to do it back then. The Fed will probably be thinking that too, and trying to avoid making the same mistake, which is why September remains on the table and will do so, until the rate announcement either validates or scratches it out of contention.

The USD has gained in the past two years after the end of its QE program announcement as the expectations of an interest rate divergence between the U.S. economy and the rest of the world. So far that rate hike has failed to materialize and if the rate hike gets pushed back further the USD will trade lower as investors discount that possibility. There is very little risk of the U.S. economy overheating if the Fed does not make a move soon, which is why the central bank can afford to be patient, but the USD will suffer as patience erodes the added value of an expected higher rate.

Forex markets events to watch today:

Thursday, September 17

- 2:35am JPY BOJ Gov Kuroda Speaks

- 3:30am CHF SNB Monetary Policy Assessment

- 4:30am GBP Retail Sales m/m

- 8:30am USD Building Permits

- 8:30am USD Unemployment Claims

- 10:00am USD Philly Fed Manufacturing Index

- 2:00pm USD FOMC Economic Projections

- 2:00pm USD FOMC Statement

- 2:00pm Federal Funds Rate

- 2:30pm USD FOMC Press Conference

- 7:30pm AUD RBA Gov Stevens Speaks

*All times EDT For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.