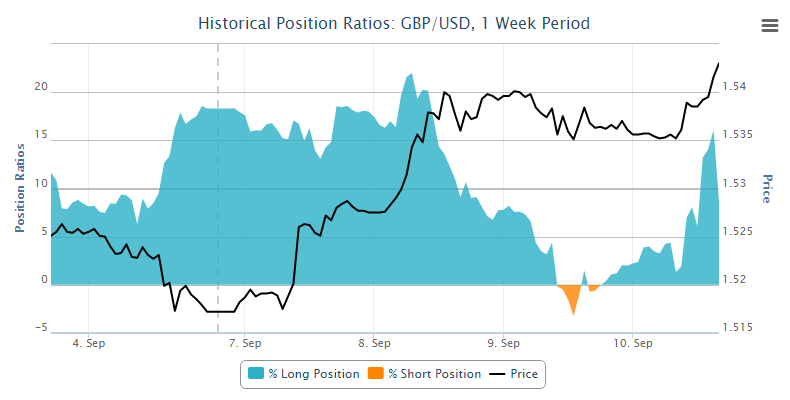

Cable is rallying again on Thursday on the back of minutes from the Bank of England that have been perceived to be hawkish but in reality were actually rather neutral. Regardless of the reason behind the rally, the pair is trading in a key resistance area – 1.5425-1.55 – and could possibly break above.

There is a lot of resistance around the current level that could either prevent price progressing further or propel it above. They include the ascending trend line – 5 May lows – the 50 fib retracement – 25 August highs to 3 September lows – and the 233-day simple moving average, among others. It is also a previous area of support and resistance.

A failure to break above this area would suggest the pair is bearish, in line with price action over the last couple of weeks, and could be seen as confirmation of the initial move below the ascending trend line. The fact that it would fail to break above the 50 fib level is also a further sign that the recent rally is nothing more than a retracement.

The first level of support could then be found around 1.5530, a recent level of support, but this may prove to be temporary. A rejection at the current support suggests any move to the downside will be stronger. A more important support level would then be 1.5265, where the pair has failed to trade below for four months.

If the pair breaks above the resistance area, it could be quite bullish, although there are still a couple of obstacles to overcome. The 89-day SMA falls around 1.5550 and this has proven to be a key level of support and resistance on numerous occasions recently so this could prove to be a key indicator of market bias.

Just above here is the 61.8% retracement of the previously mentioned move, around 1.5570.

A break above here would suggest the bias is very bullish and could prompt a move towards 25 August highs of 1.5820 and 18 June highs of 1.5930.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.