Risk appetite has improved dramatically in the markets this week as it appears that investors are finally seeing opportunities following weeks of uncertainty, volatility and heavy selling.

Overnight in Asia we saw decent gains in China where the Shanghai Composite is currently up almost 2% while in Japan, the Nikkei has rebounded strongly to trade up more than 6%. There hasn’t been a massive fundamental shift to really support these moves which suggests that it may simply be a case of bargain hunters finally deciding that the bad times are over and it’s time to get back in.

Shinzo Abe, Japan’s Prime Minister, did signal his intentions overnight to lower corporation tax, which currently stands at around 35%, to below 30% in the coming years. Abe will aim to reduce it by at least 3.3% next year in the hope that it encourages businesses to invest more and pay higher wages. This is crucial if Abe’s administration is going to follow through with the planned sales tax hike in April 2017, the last of which had a serious impact on the economy. If people are earning more, they should be able to absorb it better and the hope is that this corporation tax cut will help.

News of more fiscal spending in China on major construction projects to support the economy also appears to have been well received. It seems all of the focus recently has been on the People’s Bank of China and what it can do to support the economy. In reality, a joint effort is far more effective and it seems that the government is upping its efforts to prevent a serious slowdown.

This positivity in Asia and the U.S. overnight is certainly feeding through into Europe this morning where futures are around 2% higher ahead of the open. Focus will now switch to the U.K. where some key data is due to be released.

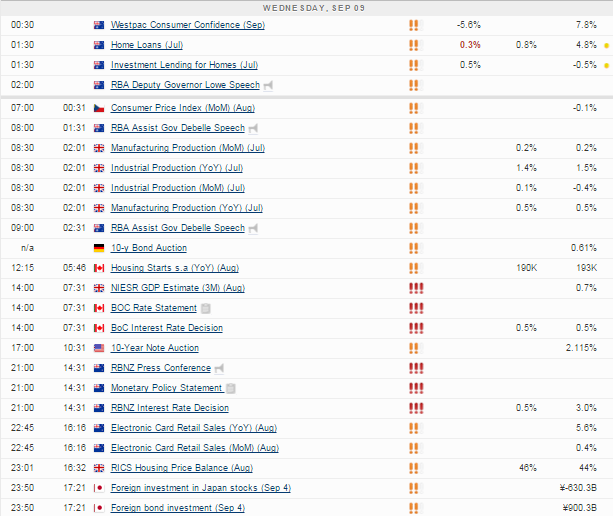

Manufacturing and industrial production figures will be released early in the session, neither of which are expected to be particularly good. The strong pound is making life difficult for U.K. manufacturers trying to compete with rivals elsewhere, which while being bad for the industry, isn’t necessarily weighing too heavily on the overall economy given how small a part it makes up. Trade balance figures and the latest NIESR GDP estimate for the three months to August make up the rest of today’s U.K. data. We’ll also get JOLTS job openings data from the U.S. later on.

The FTSE is expected to open 92 points higher, the CAC 100 points higher and the DAX 214 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.