China has largely been blamed for causing so much volatility and negativity in financial markets in recent weeks so it should be no surprise that, as its markets close in observance of Victory Day, markets in Europe and the U.S. are staging a recovery.

European indices are in the green for a second day while U.S. futures suggest we’re going to see a second day of positive trading here as well. I wouldn’t say this rally represents any significant change in sentiment in the markets, just relief at the fact that the volatility and fear that has been stemming from China has temporarily subsided.

With this being put to the back of people’s minds until next week, a couple of other key events will come to the forefront, tomorrow’s U.S. jobs report and today’s European Central Bank meeting. The recent market volatility, depreciation of the Yuan and talk of currency wars has created a headache for a number of central banks. The Federal Reserve was on course to raise interest rates in September but recent events have cast doubts on whether it can achieve its 2% inflation target in the current environment and what impact a rate hike would have on such unstable markets.

The ECB has another problem as it is nearly a year into its own quantitative easing program and inflation has remained stubbornly low. This will not be helped by lower commodity prices, while the euro’s emergence as a safe haven currency could add further deflationary pressures to the region in the coming months.

It is becoming more widely accepted that further monetary stimulus is warranted from the ECB, the only questions that remain is when and how much. Some expect the ECB to expand its quantitative easing program today but I’m not convinced this is the right time. We don’t have all the data yet and therefore don’t know what the full impact of recent market volatility and Yuan devaluation will be. Surely policy makers will want to make an informed decision rather than rushing into it.

If we do get a policy response, it could come in the form of an extension to the current quantitative easing program, possibly even making it open ended, or an increase in the size of the monthly purchases. To do the latter though, the ECB may have to look at broadening the range or quantity of assets it can buy which would complicate things further.

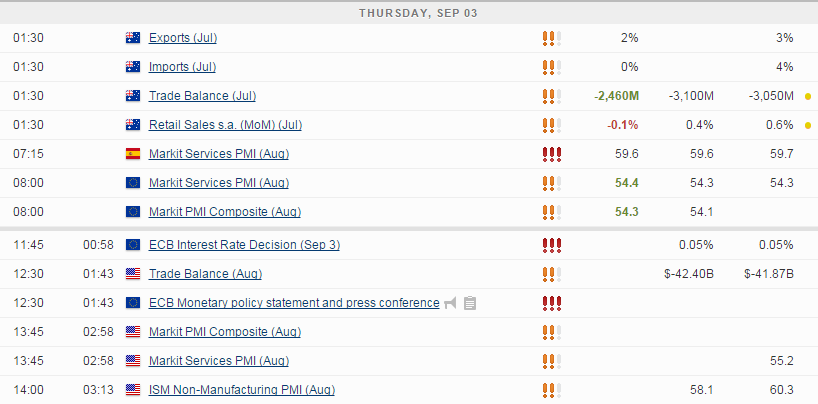

There will also be a focus on U.S. data today, with jobless claims, trade balance, the final services PMI and ISM non-manufacturing PMI all being released. As Fed vice Chair Stanley Fischer stated last week, the data over the next couple of weeks could be the difference between the central bank hiking rates and not.

The S&P is expected to open 9 points higher, the Dow 73 points higher and the Nasdaq 25 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.