The ECBs decision making process this month when confronted with ongoing low inflation in the euro area was made even harder by the slowdown in emerging markets and financial market volatility that could pose a threat further down the road.

Mario Draghi was always likely to be dovish in the meeting in an attempt to talk down the euro which has benefited from apparent safe haven flows. The decision by the ECB to increase the issue share limit on securities to 33% from 25% didn’t come as a complete shock to markets, it was one of the few options realistically available to the central bank, but it was clearly not priced in as the euro and eurozone yields fell quite sharply on the announcement while stock markets rallied.

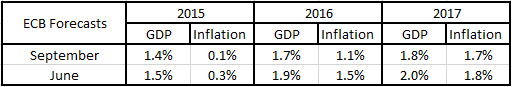

What did catch the markets really off-guard was just how dovish Draghi’s language was as he warned of renewed downside risks, highlighting the events since 12 August as being among those. Both growth and inflation forecasts from the ECB were revised significantly lower when compared with those at the June meeting, which highlights the challenging environment and the size of the task facing the central bank.

It was interesting that Draghi explicitly stated that while the asset purchase size and timeline remain the same at the moment, it could go beyond September 2016 if necessary, something that is looking increasingly probably.

This was a very downbeat press conference from the ECB today in which it repeatedly stressed the negative effects of the external environment on the euro area and its ability to achieve price stability. With that in mind, while the economies are in very different positions, it does beg the question whether the Fed will see similar headwinds in a couple of weeks and whether that will influence its decision to hike this year. This is a global market with global problems and while the US may be better positioned to deal with them, it is not completely immune.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.