As we head into the weekend, there’ll be a lot of attention on Jackson Hole, with numerous policy makers speaking ahead of what is likely to be a massive few months for central banks.

Almost every central bank is likely to be active in the next 12 months, whether they be in emerging markets and reacting to events in China, the European Central Bank and Bank of Japan contemplating more asset purchases, the Federal Reserve and Bank of England pondering a rate hike or the People’s Bank of China itself providing additional stimulus to support the economy and bring stability to financial markets.

Many of the moves are likely to be in response to either the slowdown an volatility in China or the Fed’s first rate hike in almost a decade, or both. While Chair Janet Yellen won’t be attending, there are still a number of policy makers speaking at the event including Vice Chair Stanley Fischer so we should get plenty of insight into what we can expect in the coming months and how recent events in China and global markets have impacted decision making.

Jackson Hole has often been used as a platform for the Fed Chair to drop a significant hint of an upcoming change in monetary policy but in the absence of Yellen, this is less likely. Whether that means we’re less likely to get a rate hike this year or just that Yellen is keeping her cards close to her chest isn’t clear but it would be a shock if the responsibility of feeding this to the markets was bestowed upon Vice Chair Fischer.

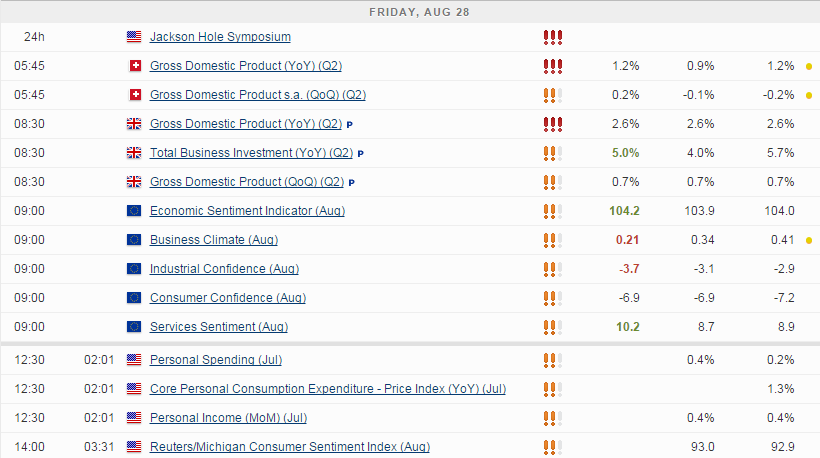

We may still see some caution from investors though, regardless of the fact that were unlikely to get the bombshell we’ve had in the past. There are a number of data releases scheduled for today which could prompt some volatility as we head into the end of the week. The core personal consumption expenditure price index – the Fed’s preferred inflation measure – is of particular interest given that this is the biggest factor standing in the way of a rate hike right now. We’re unlikely to see a big jump in the reading in the coming months as we’ve seen little sign of inflationary pressures in the economy as of late but if we can see the core reading rise at all, it could give them enough comfort to hike.

Personal income and spending figures will also be key as they could offer insight into future inflationary pressures. Spending may not have picked up dramatically following the decline in oil prices earlier this year but this could be because wage growth was so low and consumers were still deleveraging. With oil prices still low, good wage growth could spur a jump in spending and with that, provide a boost to the inflation outlook. We’ll also get the final UoM consumer sentiment reading for August which could offer insight into future spending behaviour.

The S&P is expected to open 10 points lower, the Dow 96 points lower and the Nasdaq 21 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.