On Wednesday we highlighted a key support level for cable that could offer strong insight into the pairs bullish or bearish bias going forward (GBPUSD – Big Test for Major Support).

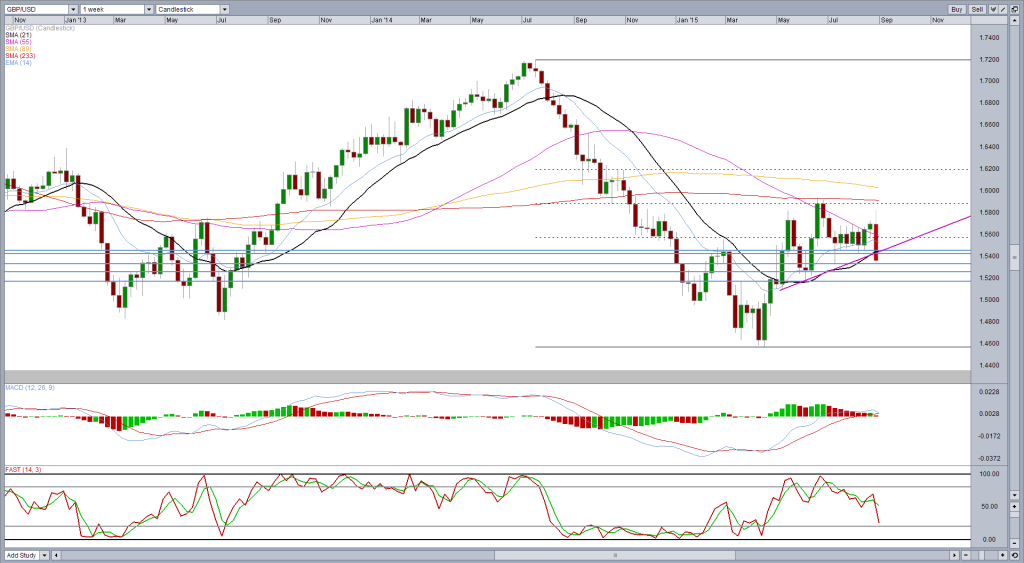

Yesterday we got a bearish signal with the break of that key support, with the 233-day and 21-week simple moving averages being broken, as well as the ascending trend line from 5 May lows and a prior region of support and resistance.

Adding to this, today we’ve had confirmation of the break following a failed retest earlier in the session which suggests the market bias is very much bearish and further downside moves could follow.

The pair has since found support around 1.5350 which has previously been a notable level of support and resistance, while further support could be found below here around 1.5330 – 8 July lows.

If the trend continues, further support could come around 1.5250 and 1.5170, both of which have been recent lows in the pair.

One note of caution comes from the MACD histogram which is experiencing divergence with price action and may suggest momentum is being lost in the short term. Of course price action is the primary indicator but this may suggest we’re going to see some form of correction or consolidation in the short term. Beyond that, the pair continues to look bearish.

One final point is that we are almost at the end of the week and the weekly candle is looking very bearish. It isn’t quite a marabuzo, but it’s still a large red candle that looks likely to close at or near its weekly lows and below the 21-week SMA and trend line.

The above tools and others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.