Europe is expected to open almost 2% higher on Thursday, boosted by a strong session in the U.S. on Wednesday and a positive session in China on the back of People’s Bank of China’s stimulus efforts.

The PBOC cut interest rates and the reserve requirement ratio on Tuesday in an attempt to encourage lending to boost China’s slowing economy and rebuild investors crumbling confidence in it. The measures appeared to bring some stability but selling continued so yesterday the central bank announced that it will inject 140 billion Yuan into the financial system via short-term liquidity operations.

The combined effort of these two stimulus measures appears to have brought some stability to Chinese markets for now and the Shanghai Composite is actually on course to record its first gains since last Wednesday. Of course, as weave seen repeatedly and not just in China, these gains can be rapidly reversed and investor behavior into the close today will tell us a lot about just how much anxiety there still is.

For now, investors in the U.S. and Europe appear content with the stabilization efforts of the PBOC which is setting us up for a more positive end to the week. Barring another steep sell-off at the end of the day in China, focus will now shift to the Jackson Hole Symposium, where a collection of central bankers and finance ministers, among others, will congregate to discuss “Inflation Dynamics and Monetary Policy”.

There will be particular attention on the Federal Reserve and what its voting FOMC members have to say on the recent activity in the markets, China and what it all means for interest rates. The Fed had previously been very clear in its views that rates should rise this year if possible but the events of the last few weeks may have changed that.

Unfortunately, a number of Fed policy makers will not be attending this year including Chair Janet Yellen. In recent years, former Chairman Ben Bernanke has used this events to strongly hint at impending changes in monetary policy, something that Yellen had the opportunity to do this week. Vice Chair Stanley Fischer is due to speak instead so we could get something but it seems much less likely.

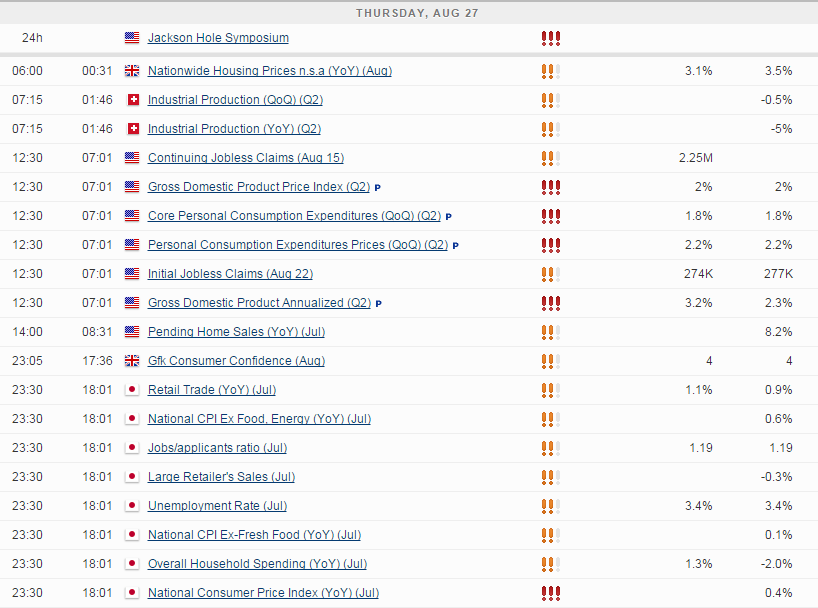

The only notable data today will also come from the U.S. with the usual weekly jobless claims data due out ahead of the open. This will accompanied by the first revision to U.S. second quarter GDP which is expected to be revised higher on an annualized basis to 3.2% from 2% previously. Pending home sales and manufacturing data will also be released later in the session.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.