It’s been an exceptional start to the trading week as sheer panic has gripped the markets following the sell-off in Asia overnight, prompting a record jump in volatility, as measured by the VIX. The VIX rose to the highest level since January 2009 as investors panic dumped equities and other risk assets.

CBOE Market Volatility Index (VIX). Source – Thomson Reuters Eikon

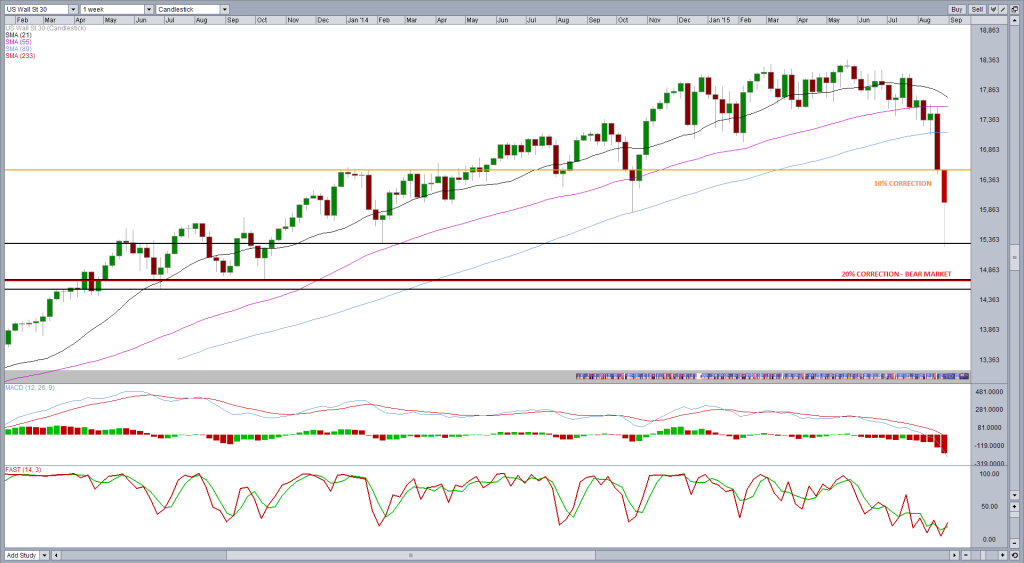

Equity markets have been hammered today, particularly around the US open with US index futures being frozen on a number of occasions having lost more than 5% before the bell. Shortly after the open the Dow was down more than 1000 points but it didn’t hold onto these losses for long and has now pared much of this to trade around 440 points, 2.65% lower.

The market volatility was not just contained to equity markets, FX markets saw some extreme levels of volatility with the yen and Swiss franc benefited from safe haven flows.

There was also significant interest in the euro will smashed though massive technical resistance against the dollar, also on apparent safe haven flow although I’m yet to be convinced about its safe haven appeal. Regardless, if this can hold above 1.1525 over the next day or so, having touched 1.1714 at one point, it would be an extremely bullish signal for the pair. Ordinarily, a daily close would be a sufficient sign but this is no ordinary day. I would like to see how traders react to these levels in the absence of market panic.

Commodity markets have been no strangers to volatility recently and they did not escape it today. Oil carried on where it left off on Friday, with WTI having closed below $40 for the first time since 3 March 2009. Eight consecutive weeks of decline have done nothing to deter oil bears and today we saw why, with Chinese fears once again spurring further declines.

All eyes will now be on China again following Monday’s 8.46% decline. The People’s Bank of China had been expected to cut rates over the weekend, the absence of which some have blamed for triggering today’s sell-off. While I don’t believe these moves can be attributed to this, a failure to act again could prompt much more market volatility tomorrow which the central bank will surely want to avoid. As we’ve seen today, fear breeds fear in the markets and the PBOC may be the only ones capable of preventing this for a second day.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.