A quieter week on the economic calendar and less news flow from Greece may be easing us into the quieter summer months however there is still plenty to focus on in the markets, with commodities grabbing plenty of attention. Meanwhile, earnings season is also well under way and could prove key in determining whether we will see rate hikes this year and companies attempt to weather the strong dollar storm.

Gold prices appear to have stabilized somewhat following some heavy selling in China at the start of the week. Still, the path of least resistance appears to remain to the downside and most people seem to be in agreement. While that can often actually be a bullish signal with a trade being overcrowded, this doesn’t appear to be the case on this occasion.

The argument to be bullish on Gold just doesn’t seem to exist and everyone appears to be in agreement. Gold is a great hedge against inflation but we’re in a low inflation environment, it’s a safe haven for times of risk aversion but risk appetite is growing now that Greece has secured a deal with creditors. With interest rates in the US likely to raise this year, Gold has just lost its appeal and while we will still see periods of upside, it certainly appears the yellow metal is headed south. It would not be surprising to see it slip below $1,000 this year, for the first time since 3 October 2009.

It wasn’t just Gold that suffered yesterday, the wider commodity market is seeing plenty of downward pressure on the back of an ever-strengthening dollar. The Iranian deal that will see sanctions lifted and oil output increased is just another thing weighing on prices right now. Brent crude is yet to find its new range but for now it appears to have found a floor around $55. It certainly appears to still look a little heavy so that could come under pressure in the coming weeks at which point $53.50 and $52 could come back into play.

There aren’t many companies reporting in Europe today so focus on that front will be firmly on the US, where Apple, Microsoft, Yahoo and Verizon are all due to report on the first quarter. We saw in the first quarter that the strong dollar was a major headwind for companies and had a negative impact on earnings. The Fed at the time described this as one of the transitory factors weighing on the economy but if these persist into the second and third quarters, they may be forced to reassess.

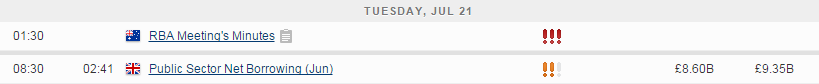

The minutes released from the Reserve Bank of Australia’s monetary policy meeting earlier this month suggested the central bank is planning to keep it steady in the coming months, despite admitting that the currency is overvalued. Falling mining investment continues to weigh on the Australian economy and with wages remaining subdued and unemployment at 6%, there still remain scope for further rate cuts.

*The minutes from the 7 July meeting can be found here.

The FTSE is expected to open 8 points higher, the CAC 2 points higher and the DAX 10 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.