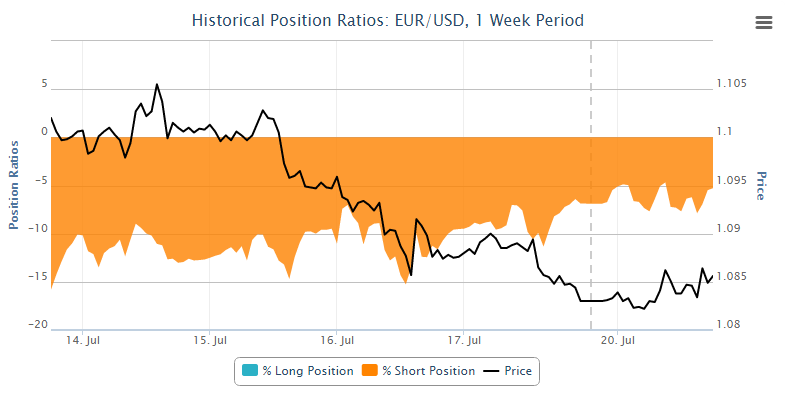

The euro is on course to start the week on a more positive note against the dollar, bringing an end to its three day losing streak that has seen it trading at an almost two-month low.

Despite the improvement today, market sentiment for the pair remains quite bearish. What we could potentially be seeing is the early stages of a consolidation or correction in the pair. Given that the pair spent most of the last week on the decline, it would not be surprising if it was the latter.

A look at the weekly chart would support this view with last week’s candle – a marabuzo – being very bearish. It’s worth noting that this can often be followed by a small move in the opposite direction despite it being so. The key test comes around the marabuzo line – the mid-point of the candle – as this holding is seen as being a bearish confirmation signal.

The first level of resistance for the pair comes around 1.0907, Friday’s high which also roughly coincides with 7 July lows. The rejection at this level on Friday could have been seen as confirmation of the ongoing sell-off, but the lack of momentum and failure to break through the 1.0820 support suggests otherwise.

If the pair can break above here at the second time of asking, it could point to the end of the downtrend for now as it would end the period of lower highs and lower lows. The next key level of resistance above here would be 1.0965, the lows from 13 and 14 July and 38.2% retracement of the move from 10 July highs to 20 July lows.

Further resistance could be found above here between 1.0990 – marabuzo line – and 1.1020, with it having previously been a key area of support and resistance. On this occasion it would also mark the 50% retracement of the above move.

It should be noted that a failure to break above 1.0907 at the first time of asking would not necessarily mean the pair is going to continue its downtrend. What could follow is the formation of an inverse head and shoulders which if broken at the neckline could prompt a more significant move to the upside, although we’re far from being in this position at this stage.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.