Federal Reserve Chair Janet Yellen will face the House Financial Services Committee on Wednesday, a session that is likely to grab the attention of investors everywhere as they search for clues on the timing of the central banks first rate hike in more than nine years.

Yesterday’s disappointing retail sales data cast doubts on whether the Fed should or will consider hiking interest rates this year with skeptics arguing that despite the additional disposable income from lower oil prices and higher wages isn’t translating into higher spending. In the absence of this, higher inflation cannot be assumed and the Fed must therefore await sufficient evidence before acting.

While this may be true, the Fed has until now been more concerned with the pace of rate hikes rather than the timing of the first and this is unlikely to have changed. If the Fed waits for spending to pick up, they may be forced to hike interest rates faster in the future which they believe would be a greater risk to the economy than a single hike this year. Assuming that they believe this change in spending and saving patterns is temporary, which they clearly do, then a rate hike this year is surely likely.

Yellen is likely to reiterate this point when she testifies on the semiannual monetary policy report today. As always, Yellen is likely to face tough questions, many of which won’t be very relevant to the markets as these things can become quite political. But it’s under this scrutiny that monetary policy hints can, intentionally or not, be dropped. This can create quite volatile market conditions, especially when the comments come only a couple of months before the rate hike could come.

Greek MPs will today vote on whether to accept the terms of the bailout plan that was agreed between Prime Minister Alexis Tsipras and the country’s creditors. The deal is seen as being worse than the one rejected by the public in a referendum a little over a week ago but seen as necessary so as to avoid a collapse of the banking system and exit from the eurozone, something some officials in Europe had started to accept during negotiations at the weekend.

Not only must MPs agree to the bailout which could then be put to governments throughout the eurozone, they also need to pass legislation on certain reforms and tax hikes that have been set as a prerequisite before creditors even consider entering into a third program. This all stems from the lack of trust among Greece’s creditors under the Syriza government as a result of its actions over the last six months and constant opposition to austerity and reforms.

Tsipras is facing staunch opposition to the bailout from certain members of his own party with 30-40 expected not to vote for it. The divisions that this has caused within the Syriza party means Tsipras will now rely on the support of opposition MPs, which he is likely to receive, but he will face issues beyond this one vote being passed. It is believed that Tsipras will be forced to reshuffle his cabinet following the vote, while there were reports that those that refused to vote in favour of the bailout would be asked to resign. There has also been suggestion that Tsipras could and should resign having failed to negotiate a good deal and deliver on election promises to reject austerity and protect pensions, but he has rejected this, claiming “The worst thing a captain could do while he is steering a ship during a storm, as difficult as it is, would be to abandon the helm.”

Just to throw a spanner into the works, the International Monetary Fund released a debt sustainability analysis yesterday, throwing its support behind Greece’s demands for debt forgiveness. This has been a constant source of disagreement between the IMF and the European Union, with members of the latter, particularly German Finance Minister Wolfgang Schaeuble, claiming that it isn’t allowed under EU treaties and therefore will not be considered. It has been suggested that IMF involvement may depend on a plan to make Greek debt sustainable in the long term, which it currently is not.

The options put forward by the IMF include a 30-year grace period on servicing its debt, both current and the new bailout, as well as long maturity extensions, annual transfers to the Greek budget or haircuts on the current Greek loans. The first option is the most likely to be considered, if any of them are at this stage, as it is unlikely to be seen to be breaking EU treaties. Even then, it is likely to be strongly opposed by Germany, but could pass as IMF involvement is seen as crucial to the bailout program. The timing of the report was very bizarre though, but possibly deliberate, coming just before each parliament in the eurozone votes on the package.

The S&P is expected to open 2 points higher, the Dow 17 points lower and the Nasdaq 12 points higher.

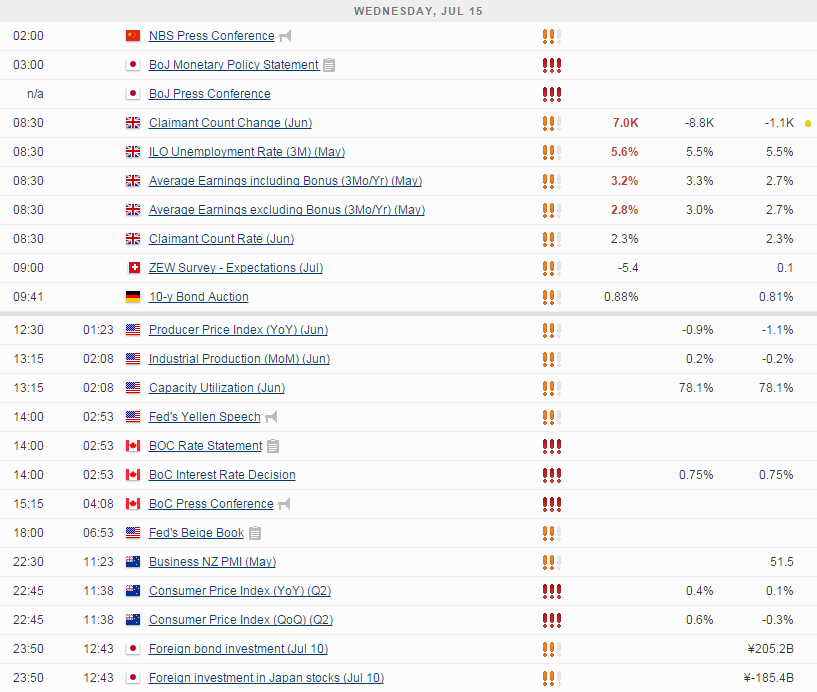

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.