It’s already been a busy start to the day in the markets, with a large batch of Chinese data being released and the Bank of Japan announcing its latest policy decision, with new forecasts. And yet, the hectic schedule has barely got underway with the Greek parliament due to vote on the bailout plan that was agreed with creditors on Monday, Federal Reserve Chair Janet Yellen to testify before the House Financial Services Committee and a large batch of data to be released including the U.K. jobs report.

Clearly the most important thing today is the Greek vote on the bailout plan and the passing of the proposed reforms needed to secure bridging loans that will enable the country to avoid default. If the vote passes in parliament – which will most likely require the support of opposition parties as MPs within the Syriza party rebel – a total banking collapse will also be avoided as the European Central Bank would likely agree to raise the emergency liquidity assistance (ELA) ceiling. This really is a hugely important but difficult vote that is effectively a choice between three more years of painful austerity or a potentially brutal and messy Greek exit from the eurozone.

It’s because of this that the vote is likely to pass in parliament today and enable similar votes to take place by Friday the parliaments of Greece’s creditors. Given that Greece has effectively been forced to concede on almost every aspect of the deal in what has turned out to be a humiliating U-turn for Greek Prime Minister Alexis Tsipras, I would be very surprised if any of the creditor countries reject the deal. Still, there is still a long way to go before Greece’s place within the euro is secured for a few more years at least.

Also of huge interest to investors today will be Yellen’s testimony on the semi-annual monetary policy report which comes only two months before the Fed is widely expected to raise interest rates for the first time in more than nine years. There are a large number of people that believe the Fed should hold off until next year as there is not enough evidence that inflation will return to target within the forecasting period, with wages only recently picking up notably and consumer spending remaining quite subdued, despite the additional disposable income enjoyed as a result of lower oil prices.

However, Yellen and many of her colleagues have stood firm on the belief that the first hike should come this year and she is likely to reiterate that point when she speaks before the committee today. How she justifies it will be of enormous interest because it could be the strength of her argument that either convinces or dissuades people about the likelihood of a hike.

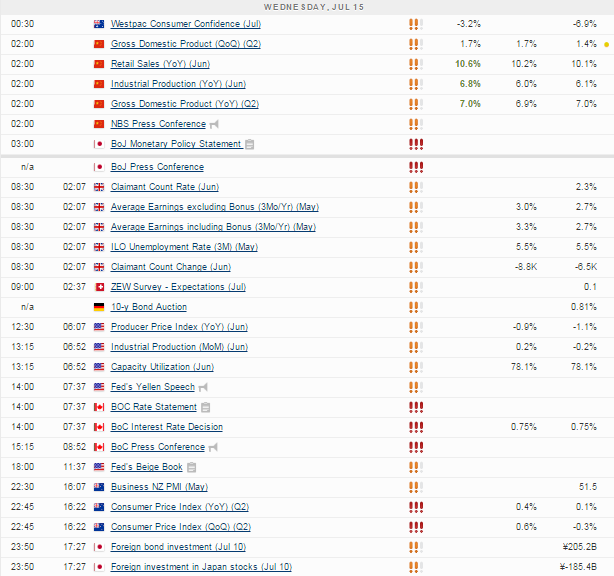

The U.K. jobs report will also be of interest today, although it does fall some way down the pecking order compared to the Greek vote and Yellen’s speech. That said, Bank of England Governor did yesterday suggest that the first rate hike in the U.K. could come earlier than is currently expected, while David Miles claimed in his final speech before stepping down next month that the case for raising rates is stronger than at any point since he joined in 2009. Given his typically dovish stance that is some statement and suggests the voting could get a lot more interesting in the coming months.

It also brings some added interest to the data as any improvements could further support these views. The most important areas for me are those that support inflation returning to the BoEs 2% target, which today would be the average earnings figure. This is believed to have risen to 3.3% in May from 2.7% the month before, continuing the upward trajectory and supporting the view that conditions are gradually improving. The unemployment rate is expected to remain at 5.5% while jobless claims are expected to have fallen by 8,800.

Data released in China overnight painted a better picture of the Chinese economy than was expected, showing growth of 7% in the second quarter compared to a year ago, while the country also beat expectations on urban investment, retail sales and industrial production. The latter two were actually far better than we were expecting. Once again though, these figures have called into question the reliability of the official figures, with some suggesting Chinese growth is substantially lower than it appears. The figures do suggest though that all of the monetary stimulus this year is having an impact although what we’re now left with is possibly a scenario in which good news is bad news for the markets, with the Shanghai Composite responding by plummeting more than 4%. Although this may just reflect the disconnect between the index and fundamentals.

The BoJ this morning kept its policy stance on hold, which was widely expected. The central bank also cut growth forecasts for the current fiscal year to 1.7% from 2% previously while inflation forecasts for the next few years were revised marginally lower. Its assessment of the economy though was largely unchanged, retaining the view that the economy continues to recover moderately.

The FTSE is expected to open 19 points lower, the CAC 9 points higher and the DAX 10 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.