It’s been a rather bizarre start to the trading session on Friday, as all the negativity around more failed Greek talks, possible default and capital controls over the weekend is met with strong gains in equity markets and falling yields in bond markets.

We are headed into one of the most uncertain weekends for a long time and yet looking at the markets you’d swear everything is hunky dory. Talks failed once again at yesterday’s eurogroup meeting and none of the language that followed from senior officials was positive. Eurogroup Head Jeroen Dijsselbloem was very pessimistic about a deal being done in time for a disbursement to be made to Greece by 30 June, when a €1.6 billion repayment is due to the International Monetary Fund.

While the IMF has claimed that no grace period will be afforded to Greece, you would imagine if a deal is reached before then they would accept a late payment and not deem them to have defaulted. But a lot needs to be done before that can even be considered and progress is simply not being made. Greece Finance Minister Yanis Varoufakis claimed after the eurogroup meeting that its latest “deficit break” proposal wasn’t even discussed. This hardly suggests the two sides are getting any closer to a deal.

Another point of concern is reported comments from ECB Executive Committee member Benoit Coeure who apparently claimed that he didn’t know whether banks would be open on Monday. This suggests that he anticipated capital controls possibly being imposed in Greece over the weekend following the surge in withdrawals that have occurred this week. The ECB will discuss its ELA program today via teleconference and if it decides to reduce the funding it offers, either through haircuts or by cutting Greek banks off altogether, capital controls would be extremely likely.

An emergency E.U. summit has been arranged for Monday for discussions on Greek reforms to continue in an attempt to resolve the impasse. The meeting comes eight days before the repayment is due to the IMF which should apply great pressure to both sides to come to some agreement, even a short-term deal that allows the country to avoid defaulting. Without a deal on Monday, the European Central Bank may opt to lean on Greek officials and apply haircuts to the collateral received from the country’s banks. That’s assuming they don’t do so today, with Greek banks apparently confident of raising their borrowing via the emergency liquidity assistance program by €3.5 billion.

With all of this risk over the weekend, it doesn’t feel like there’s much to be optimistic about. It’s been suggested that the gains in European markets and in US futures can be attributed to optimism over a deal being done or a belief that a “Grexit” would be a positive thing but this seems a little hard to believe. Two other things would explain today’s moves much better. Either they’re technical, with many European indices ending yesterday’s session with rather bullish setups, either hammer candles or engulfing patterns, which would explain today’s correction after large losses recently. Or, today’s quadruple witching is driving the bizarre moves, which again is more likely than anything Greece associated.

One clue could come from how indices end the day. If we see heavy selling into the end of the session, it would highlight just how worried people really are heading into such an uncertain weekend. The problem is that if we see some very negative developments over the weekend, markets could gap significantly lower on the open on Monday which can cause quite a bit of panic.

The S&P is expected to open 3 points higher, the Dow 32 points higher and the Nasdaq 12 points higher.

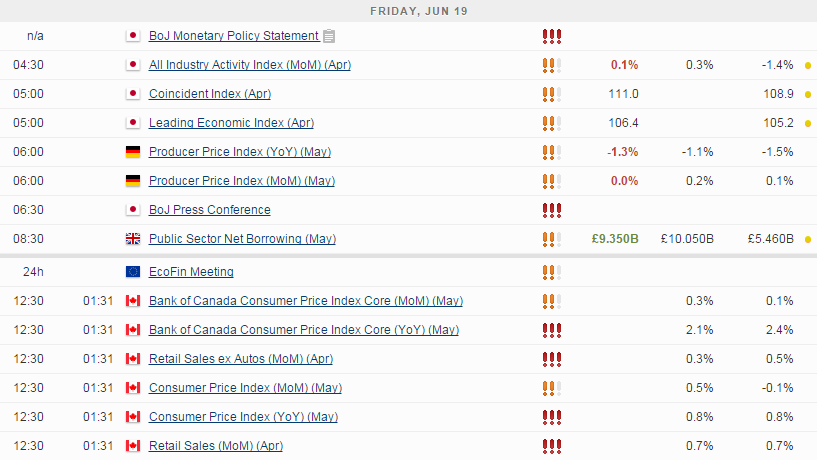

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.