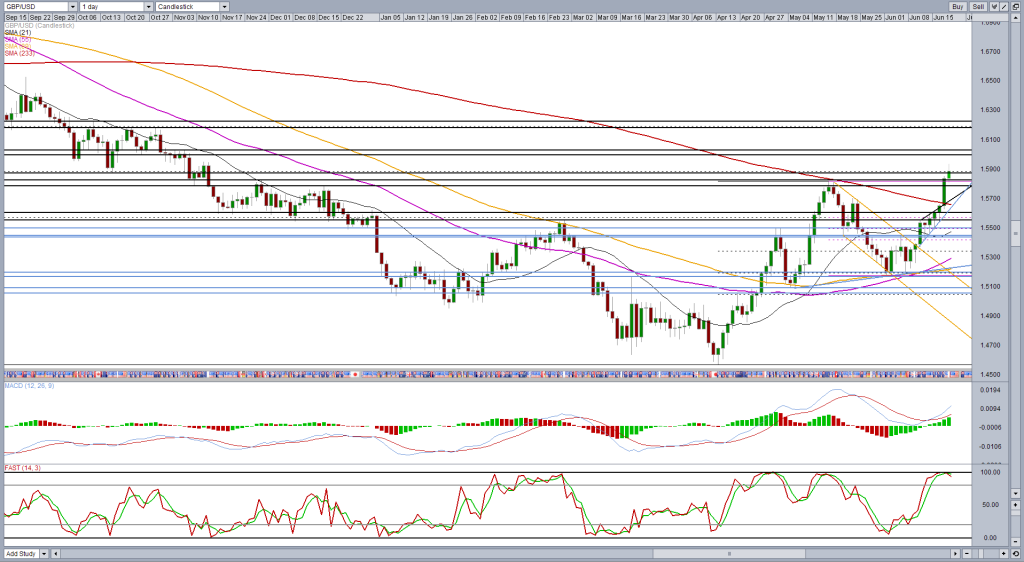

Cable has broken to new seven month highs, spurred on by a combination of better than expected UK wage growth and retail sales figures and a dovish message from the Fed that provided the perfect catalyst to break significantly through a couple of big resistance levels.

In the lead up to both of these the pair was starting to show signs of indecision and if anything, the bears were beginning to look like they could take control. But once the ascending wedge and 233-day simple moving average were broken, it became clear that the bulls were back in full control. Of course, had the Fed been more hawkish on Wednesday, this may have been reversed but instead its insistence on rate hikes being slower was seen as dovish which is bearish for the dollar.

This was enough for cable to drive through 14 May highs and it appears the final hurdle in this cluster of resistance levels, 1.5875, is holding up no better. If we see a close above this level, it would suggest to me that the bulls are strong as this also marks the 50% retracement of the move from 15 July 2014 highs to 13 April lows.

The next area of resistance for the pair above here comes around 1.60-1.6030. This has previously been a key area of support and resistance and while it has no technical significance, it can quite often be the case that large round numbers can be psychological barriers, even if on a temporary basis.

Above here further resistance may be found around 1.6180-1.6225 – key support and resistance in September and October last year and the 61.8% retracement of move highlighted previously.

*The above tools and many others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.