European indices are expected to open lower again on Tuesday as fears grow that Greece could default on its debt and put its place in the eurozone at risk.

Negotiations have hit rough patches on numerous occasions throughout this process but this is the first time that they appear to have totally collapsed. At this stage it is difficult to see how this will be resolved without significant compromises being made, something both sides have absolutely no interest in.

Greek Prime Minister Alexis Tsipras has taken a hard stance on negotiations since being elected in January on the promise of rejecting new austerity measures while remaining in the euro. The problem is, in reality Tsipras looks to have promised things that could not be delivered at that election and as a result is putting Greece in a very bad position. The phrase beggars can’t be chooses seems totally lost on him.

His tough stance is admirable as Greek people have endured a very difficult five years and further cuts will make it harder still, but there are two parties in these negotiations and the creditors have far more leverage. Any solution must also be palatable to their politicians and tax payers.

The other thing to consider is that if Greece continues on its current collision course, Tsipras will only fulfill part of his mandate as Greece could ultimately become bankrupt and leave the eurozone. Polls are showing that Greeks want a deal and to stay in the eurozone, at some point Tsipras may have to ask himself which election promise does he wish to keep. Something tells me there’s still far more drama and an 11th hour deal to come.

The worrying thing is that deposit outflows at Greek banks are gathering pace with another €400 million being withdrawn yesterday. Rumours that capital controls will be put in place this weekend if no deal is agreed have been denied by a Greek government official but the way things are going, I think it’s only a matter of time until the European Central Bank is forced to impose haircuts on the collateral it can accept from Greek banks as part of the emergency liquidity assistance (ELA) program, at which point the government will have no other option if they want to avoid a crisis.

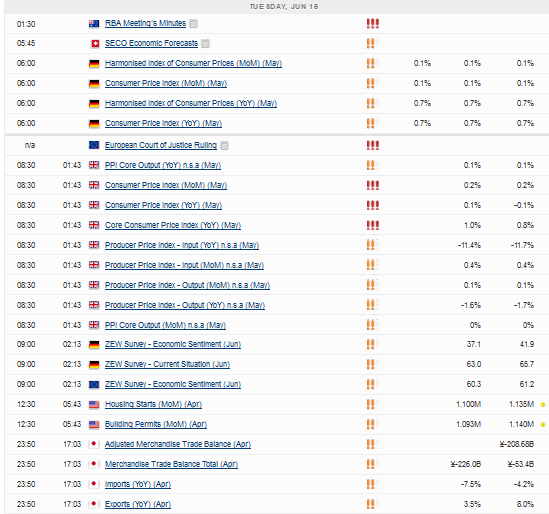

Economic sentiment readings from ZEW for Germany and the eurozone for June will be released this morning and are expected to show this ongoing Greek uncertainty and threat of a “Grexit” further weighing on sentiment. Both numbers are expected to decline but I wouldn’t be surprised to see them fall short of expectations as the odds of a Greek default have risen significantly this month.

We’ll also get inflation data from the U.K. which is expected to show price growth of 0.1% in May from a year earlier. This is probably largely driven by a rebound in oil prices which overall continue to act as a massive drag on the CPI reading. Core inflation is expected to have risen by 1% in the month but is likely to remain subdued for some time yet.

The European Court of Justice will rule on the legality of the ECBs Outright Monetary Transactions program today. The announcement of the program had a massive impact on the eurozone crisis and ECB President Mario Draghi’s now infamous declaration to do “whatever it takes” was the big turning point as it became clear that the ECB would buy the debt on the secondary market of countries that signed up for an adjustment program. In other words, when borrowing costs became too high the ECB would step in a create a backstop and governments would not default. Of course, as we now see this only works if the government is willing to agree to reforms.

Some economists, particularly those in Germany and specifically Bundesbank Head Jens Weidmann, have always claimed this support amounts to monetary financing of governments which is illegal under E.U. treaty law. The ECB believes it got around this as the program involved purchasing debt on the secondary market, which despite being a technicality, is likely to result in the ECJ ruling it its favour.

At the end of the day, the ECB has never had to actually use the OMT program as the mere announcement of it gave investors the backstop they wanted a drove yields significantly lower. If the ECJ ruled against the ECB, I don’t think it would make a huge difference as the ECB has not implemented it and countries that could use it don’t need it any more.

The FTSE is expected to open 14 points lower, the CAC 23 points lower and the DAX 59 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.